Unveiling the Power of Finance ERP Systems: A Comprehensive Guide to Value, Urgency, and Action

Introduction

In the ever-evolving landscape of business, finance has emerged as a cornerstone of operational efficiency and strategic decision-making. Amidst the plethora of technological advancements, finance ERP systems have ascended as indispensable tools, empowering organizations to streamline their financial processes, enhance data integrity, and gain unprecedented visibility into their financial performance.

This comprehensive guide delves into the multifaceted world of finance ERP systems, meticulously dissecting their value propositions and unraveling the key pain points they alleviate for ideal customer personas. By crafting a compelling narrative that showcases the transformative power of these systems, we aim to ignite a sense of urgency that drives decisive action towards adopting these transformative solutions.

Understanding the Value Propositions of Finance ERP Systems

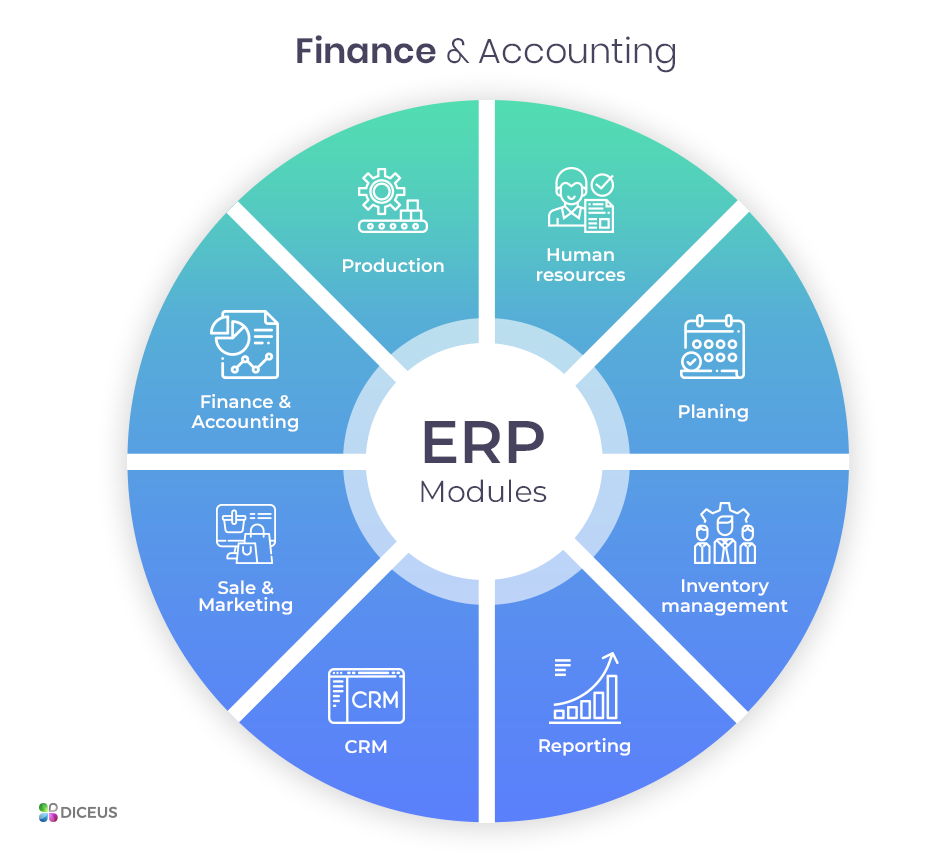

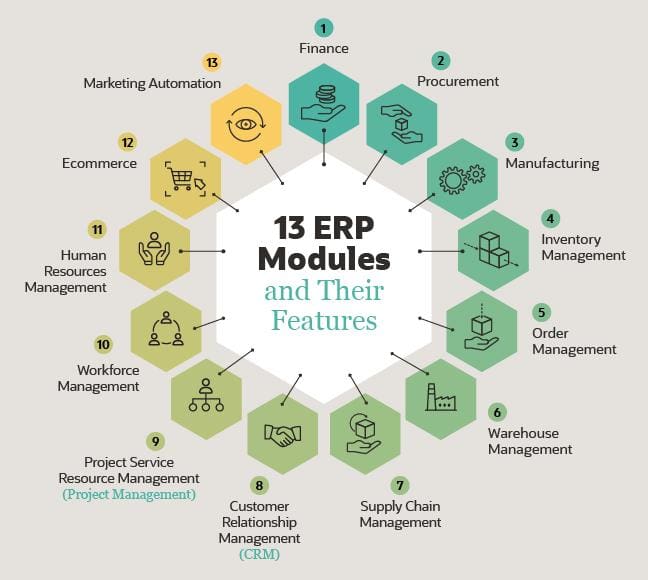

Finance ERP systems transcend the realm of mere accounting software, offering a comprehensive suite of capabilities that revolutionize the way organizations manage their financial operations. These systems seamlessly integrate core financial processes, including:

-

General Ledger Management: Centralized control over financial transactions, ensuring accuracy and compliance.

-

Accounts Payable Automation: Streamlined invoice processing, eliminating manual errors and expediting payments.

-

Accounts Receivable Management: Efficient tracking of customer invoices, enhancing cash flow visibility.

-

Fixed Assets Management: Comprehensive monitoring of capital assets, optimizing depreciation schedules and maintenance planning.

-

Budgeting and Forecasting: Data-driven financial planning, enabling informed decision-making and strategic resource allocation.

-

Financial Reporting and Analysis: Real-time access to financial data, facilitating insightful analysis and timely reporting.

Addressing the Key Pain Points of Ideal Customer Personas

Finance ERP systems are meticulously designed to alleviate the pressing pain points experienced by ideal customer personas, including:

-

Data Disparity and Inaccuracy: Disparate systems and manual processes lead to data inconsistencies, hindering accurate reporting and decision-making.

-

Inefficient Processes: Labor-intensive manual tasks consume valuable time and resources, impeding productivity and innovation.

-

Limited Visibility and Control: Fragmented financial data limits visibility into key performance indicators, hindering strategic planning and risk management.

-

Compliance Challenges: Manual processes and disparate systems increase the risk of compliance violations, exposing organizations to penalties and reputational damage.

-

Lack of Real-Time Insights: Delayed access to financial data hampers timely decision-making and proactive response to market dynamics.

Advantages and Disadvantages of Finance ERP Systems

Advantages:

-

Enhanced Data Accuracy and Consistency: Centralized data management ensures consistency and accuracy, eliminating errors and discrepancies.

-

Streamlined Processes and Automation: Automated workflows and integrated processes significantly reduce manual tasks, freeing up resources for value-added activities.

-

Improved Visibility and Control: Real-time access to financial data provides a comprehensive view of the organization’s financial performance, enabling informed decision-making.

-

Enhanced Compliance: Built-in compliance features and automated processes minimize the risk of non-compliance, safeguarding the organization’s reputation and financial health.

-

Real-Time Insights and Reporting: Instant access to financial data empowers organizations to make data-driven decisions and generate timely reports.

Disadvantages:

-

Implementation Costs and Complexity: Implementing a finance ERP system can be a complex and costly endeavor, requiring significant investment and resources.

-

Data Migration Challenges: Migrating data from legacy systems can be time-consuming and error-prone, potentially disrupting operations.

-

Training and Adoption: Employees may require extensive training to effectively utilize the new system, potentially impacting productivity in the short term.

-

Customization Limitations: ERP systems may not be fully customizable to meet the unique requirements of every organization, necessitating workarounds or additional development.

-

Vendor Dependency: Organizations become dependent on the ERP vendor for maintenance, updates, and support, which can impact flexibility and agility.

Summary of Finance ERP Systems

Finance ERP systems are comprehensive software solutions that seamlessly integrate core financial processes, offering a multitude of benefits, including:

-

Enhanced data accuracy and consistency

-

Streamlined processes and automation

-

Improved visibility and control

-

Enhanced compliance

-

Real-time insights and reporting

While implementation costs, data migration challenges, and vendor dependency are potential considerations, the long-term value proposition of finance ERP systems far outweighs these drawbacks.

Q&A

1. What is the primary function of a finance ERP system?

Finance ERP systems centralize and automate core financial processes, providing a comprehensive view of an organization’s financial performance.

2. How do finance ERP systems improve data accuracy?

By centralizing data in a single system, finance ERP systems eliminate data duplication and inconsistencies, ensuring accuracy and reliability.

3. What are the benefits of automating financial processes?

Automation streamlines tasks, reduces errors, and frees up resources for more strategic initiatives, enhancing productivity and efficiency.

4. How do finance ERP systems enhance visibility and control?

Real-time access to financial data provides a comprehensive view of the organization’s financial performance, enabling informed decision-making and proactive risk management.

5. What are the compliance benefits of finance ERP systems?

Built-in compliance features and automated processes minimize the risk of non-compliance, safeguarding the organization’s reputation and financial health.

6. What are the potential challenges of implementing a finance ERP system?

Implementation costs, data migration, training, customization limitations, and vendor dependency are potential challenges that need to be carefully considered.

7. How can organizations mitigate the risks associated with finance ERP implementation?

Thorough planning, vendor due diligence, data preparation, and employee training can significantly reduce the risks associated with finance ERP implementation.

8. What is the ROI of a finance ERP system?

The ROI of a finance ERP system can be significant, resulting from increased efficiency, improved decision-making, enhanced compliance, and reduced operational costs.

9. What are the key considerations for selecting a finance ERP system?

Factors to consider include the organization’s size, industry, specific requirements, budget, and long-term strategic goals.

10. What are the emerging trends in finance ERP systems?

Cloud-based ERP, artificial intelligence, machine learning, and predictive analytics are emerging trends shaping the future of finance ERP systems.

11. How can organizations prepare for the future of finance ERP systems?

Embracing cloud technology, investing in employee training, and partnering with forward-thinking ERP vendors can help organizations prepare for the future of finance ERP systems.

12. What are the benefits of partnering with an experienced ERP implementation consultant?

Experienced consultants provide expertise, guidance, and support throughout the implementation process, ensuring a successful outcome.

13. How can organizations maximize the value of their finance ERP system?

Regular system updates, ongoing training, and continuous process improvement initiatives can help organizations maximize the value of their finance ERP system.

Conclusion

Finance ERP systems are transformative tools that empower organizations to streamline their financial operations, enhance data integrity, and gain unprecedented visibility into their financial performance. By addressing the key pain points of ideal customer personas, these systems unlock a wealth of benefits, including enhanced accuracy, streamlined processes, improved visibility, enhanced compliance, and real-time insights.

While implementation challenges exist, the long-term value proposition of finance ERP systems is undeniable. Organizations that embrace these solutions position themselves for sustained growth, operational excellence, and a competitive edge in the dynamic business landscape.

Closing Statement

In an era where data-driven decision-making and operational efficiency are paramount, finance ERP systems have emerged as indispensable tools for organizations seeking to thrive in the face of evolving challenges. By investing in these transformative solutions, organizations can unlock their full financial potential, empowering them to make informed decisions, mitigate risks, and drive sustainable growth.