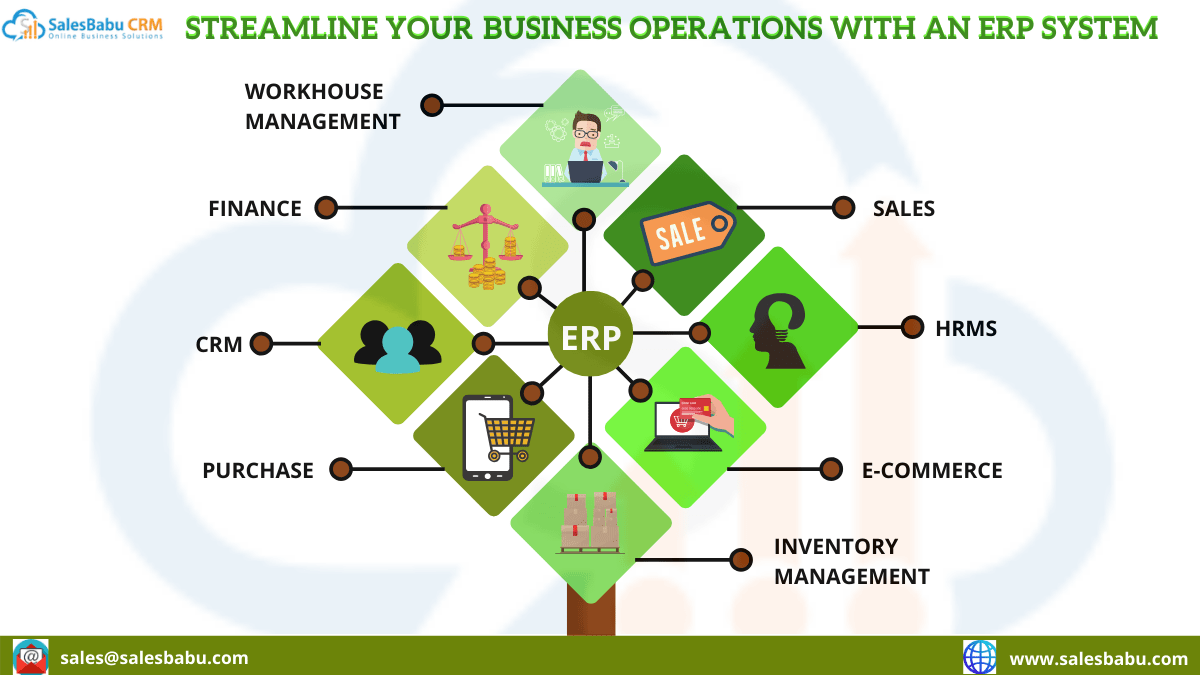

Streamlining Your Business: The Power of ERP Payment Systems

.

.

Welcome, fellow business leaders and entrepreneurs! In today’s dynamic and ever-evolving business landscape, efficiency and seamless operations are paramount to success. As your business grows, managing finances, tracking transactions, and ensuring accurate payments can become a complex and time-consuming endeavor. This is where ERP payment systems emerge as a powerful solution, offering a centralized platform to streamline your financial processes and unlock a new level of operational efficiency.

Imagine a world where all your financial data is seamlessly integrated, from customer invoices to supplier payments. With an ERP payment system, this vision becomes a reality. This sophisticated software solution acts as a central hub, connecting your accounting, inventory, and sales systems to provide a comprehensive overview of your financial health. By automating repetitive tasks and eliminating manual data entry, ERP payment systems free up your valuable time, allowing you to focus on strategic decision-making and driving business growth.

But the benefits extend far beyond mere automation. ERP payment systems offer a robust set of features designed to enhance every aspect of your financial management. From automated invoice generation and payment processing to real-time financial reporting and insightful analytics, these systems empower you to gain unprecedented control over your finances. By providing a clear picture of your cash flow, you can make informed decisions regarding investments, inventory management, and resource allocation, ultimately optimizing your business performance.

Moreover, ERP payment systems play a crucial role in ensuring compliance with regulatory requirements. With built-in features that enforce adherence to industry standards and best practices, you can rest assured that your financial operations are conducted with integrity and transparency. This peace of mind allows you to focus on core business activities, knowing that your financial data is secure and compliant.

.

.

However, the journey to adopting an ERP payment system is not without its challenges. Choosing the right system for your specific needs can be a daunting task, requiring careful consideration of your business size, industry, and specific requirements. Furthermore, implementing and integrating the system into your existing workflows can be a complex process that demands thorough planning and execution.

Despite these hurdles, the potential benefits of ERP payment systems far outweigh the initial challenges. By streamlining your financial processes, improving operational efficiency, and providing valuable insights into your financial health, these systems can empower your business to reach new heights of success.

Navigating the Landscape: Choosing the Right ERP Payment System

Before embarking on your journey to implement an ERP payment system, it’s essential to understand the diverse options available and carefully evaluate which system best aligns with your unique business needs. The market is saturated with a wide range of ERP payment systems, each offering a distinct set of features and functionalities.

1. Cloud-Based vs. On-Premise Solutions:

The first major decision you’ll face is whether to opt for a cloud-based or on-premise ERP payment system. Cloud-based solutions, hosted on remote servers, offer greater flexibility and scalability, allowing you to access your data from any location with an internet connection. This accessibility is particularly advantageous for businesses with geographically dispersed teams or those seeking to minimize hardware and maintenance costs.

.

.

On-premise solutions, on the other hand, involve installing the software on your company’s servers. This approach offers greater control over your data and infrastructure, providing a higher level of security for sensitive financial information. However, on-premise solutions require significant upfront investment in hardware, software licenses, and ongoing maintenance, which can be a major deterrent for smaller businesses.

2. Feature-Rich Solutions for Enterprise-Level Operations:

For large enterprises with complex financial operations, feature-rich ERP payment systems offer comprehensive functionality to manage intricate workflows and vast amounts of data. These systems often integrate seamlessly with other enterprise-level software solutions, such as CRM and supply chain management systems, providing a unified view of your business operations.

3. Streamlined Solutions for Small and Medium-Sized Businesses:

Smaller businesses may find that feature-rich ERP payment systems are overkill for their needs. Streamlined solutions designed specifically for SMBs offer a simplified user interface and a more affordable price point, making them an ideal choice for businesses with limited IT resources.

.

.

4. Industry-Specific Solutions for Tailored Functionality:

Certain industries have unique financial requirements and workflows. Industry-specific ERP payment systems are tailored to address these specific needs, providing pre-configured modules and functionalities that streamline operations within your sector.

5. Open-Source Solutions for Customization and Flexibility:

Open-source ERP payment systems offer greater flexibility and customization options, allowing you to modify the software to meet your specific requirements. This approach can be advantageous for businesses with highly specialized needs or those seeking to avoid vendor lock-in.

6. Evaluating Your Business Needs:

To determine the most suitable ERP payment system for your business, it’s crucial to conduct a thorough evaluation of your needs. Consider factors such as:

- Business size and complexity: Larger enterprises with complex financial operations may require a more robust and feature-rich solution, while smaller businesses may find a streamlined system more suitable.

- Industry-specific requirements: Certain industries have unique financial needs and regulations that require specialized functionalities.

- Budget constraints: ERP payment systems can range in price from a few hundred dollars per month to thousands of dollars per year.

- Integration with existing systems: Ensure the chosen system can seamlessly integrate with your existing accounting, inventory, and sales systems.

- Scalability and future growth: Select a system that can accommodate your business’s future growth and evolving needs.

.

.

7. Demystifying the Implementation Process:

Implementing an ERP payment system can be a complex undertaking, requiring careful planning and execution. Here’s a step-by-step guide to ensure a smooth transition:

- Define your business goals and requirements: Clearly articulate your objectives for implementing an ERP payment system, including desired improvements in efficiency, accuracy, and compliance.

- Conduct a thorough needs assessment: Identify your current pain points and areas for improvement in your financial processes.

- Select the right system: Carefully evaluate different ERP payment systems based on your business needs, budget, and integration requirements.

- Develop a comprehensive implementation plan: Outline the steps involved in implementing the system, including data migration, user training, and system testing.

- Ensure adequate support and training: Provide your team with the necessary training and support to effectively use the new system.

- Monitor and evaluate the system’s performance: Regularly assess the system’s effectiveness in meeting your business goals and identify areas for improvement.

ERP Payment Systems: A Comprehensive Overview

ERP payment systems have revolutionized financial management, empowering businesses to streamline their operations, enhance efficiency, and gain valuable insights into their financial health. These systems offer a wide range of features and functionalities, catering to the unique needs of businesses of all sizes and industries.

1. Centralized Financial Management:

ERP payment systems provide a central hub for managing all your financial data, from customer invoices to supplier payments. This centralized approach eliminates the need for multiple spreadsheets and disparate systems, simplifying your financial operations and reducing the risk of errors.

2. Automated Invoice Generation and Processing:

With automated invoice generation, you can eliminate manual data entry and streamline the invoicing process. ERP payment systems can automatically generate invoices based on sales orders, track invoice status, and send reminders to customers, ensuring timely payment collection.

3. Automated Payment Processing:

ERP payment systems automate the payment processing workflow, eliminating the need for manual checks or wire transfers. These systems can integrate with various payment gateways, allowing you to accept payments from multiple sources, including credit cards, bank transfers, and digital wallets.

4. Real-Time Financial Reporting and Analytics:

ERP payment systems provide real-time access to your financial data, allowing you to monitor your cash flow, track expenses, and analyze performance trends. This data-driven approach empowers you to make informed decisions and optimize your business operations.

5. Enhanced Security and Compliance:

ERP payment systems incorporate robust security measures to protect your sensitive financial data from unauthorized access. These systems also enforce compliance with industry standards and regulations, ensuring that your financial operations are conducted with integrity and transparency.

6. Improved Customer Relationships:

By streamlining the payment process and providing a clear and transparent view of your financial transactions, ERP payment systems can enhance customer satisfaction and build stronger relationships.

7. Increased Efficiency and Productivity:

By automating repetitive tasks and eliminating manual data entry, ERP payment systems free up your valuable time, allowing you to focus on strategic decision-making and driving business growth.

ERP Payment Systems: Advantages and Disadvantages

While ERP payment systems offer numerous benefits, it’s essential to consider both the advantages and disadvantages before making a decision.

Advantages:

- Improved Efficiency and Productivity: ERP payment systems automate repetitive tasks, freeing up your time for strategic decision-making.

- Enhanced Accuracy and Reduced Errors: Centralized data management and automated processes minimize the risk of human error.

- Real-Time Financial Reporting and Insights: Gain access to up-to-date financial information to make informed decisions.

- Improved Cash Flow Management: Streamlined payment processing and automated reminders ensure timely payment collection.

- Enhanced Security and Compliance: Robust security measures protect your sensitive financial data and ensure compliance with regulations.

- Improved Customer Satisfaction: Streamlined payment processes and transparent communication enhance customer relationships.

- Scalability and Growth: ERP payment systems can adapt to your business’s evolving needs and growth.

Disadvantages:

- Implementation Costs: Implementing an ERP payment system can involve significant upfront investment in software licenses, hardware, and training.

- Complexity and Learning Curve: Some systems can be complex to implement and require extensive training for your team.

- Integration Challenges: Integrating the system with your existing software solutions can be challenging and require technical expertise.

- Vendor Lock-in: Choosing a specific ERP payment system can create vendor lock-in, making it difficult to switch to another provider in the future.

- Data Security Risks: Despite robust security measures, data breaches can still occur, posing a risk to your sensitive financial information.

ERP Payment Systems: A Comprehensive Summary

ERP payment systems are powerful software solutions that revolutionize financial management by streamlining processes, enhancing efficiency, and providing valuable insights into your financial health. These systems offer a wide range of features and functionalities, catering to the unique needs of businesses of all sizes and industries.

Key Features:

- Centralized financial management: A single platform for managing all your financial data.

- Automated invoice generation and processing: Streamlined invoicing with automated generation and reminders.

- Automated payment processing: Seamless integration with payment gateways for efficient payment collection.

- Real-time financial reporting and analytics: Gain insights into your cash flow, expenses, and performance trends.

- Enhanced security and compliance: Robust security measures protect your sensitive financial data and ensure regulatory adherence.

Benefits:

- Improved efficiency and productivity: Automate tasks and free up your time for strategic decision-making.

- Enhanced accuracy and reduced errors: Minimize the risk of human error through centralized data management and automation.

- Better cash flow management: Streamline payment processing and ensure timely collection.

- Improved customer relationships: Enhance customer satisfaction through streamlined payment processes and transparent communication.

- Scalability and growth: Adapt to your business’s evolving needs and future growth.

Challenges:

- Implementation costs: Significant upfront investment in software, hardware, and training.

- Complexity and learning curve: Requires time and effort to implement and train your team.

- Integration challenges: Integrating the system with existing software can be complex.

- Vendor lock-in: Choosing a specific system can make it difficult to switch providers later.

- Data security risks: Despite security measures, data breaches can still occur.

Conclusion: Empowering Your Business with ERP Payment Systems

In the competitive business landscape, efficiency and streamlined financial operations are essential for success. ERP payment systems provide a powerful solution, empowering businesses to manage their finances effectively, improve operational efficiency, and gain valuable insights into their financial health.

By automating repetitive tasks, eliminating manual data entry, and providing real-time financial reporting, ERP payment systems free up your valuable time, allowing you to focus on strategic decision-making and driving business growth. These systems also enhance security and compliance, ensuring that your financial operations are conducted with integrity and transparency.

While implementing an ERP payment system can involve challenges, the potential benefits far outweigh the initial hurdles. By carefully evaluating your business needs, selecting the right system, and developing a comprehensive implementation plan, you can unlock the transformative power of these solutions and propel your business to new heights of success.

Take Action Today:

- Assess your current financial processes: Identify areas for improvement and determine if an ERP payment system is the right solution for your business.

- Research different ERP payment systems: Explore the market and compare features, functionalities, and pricing to find the best fit for your needs.

- Schedule a consultation with a reputable ERP vendor: Discuss your business requirements and explore implementation options.

By taking action today, you can embark on a journey towards streamlined financial operations, enhanced efficiency, and greater financial control.

Disclaimer:

This article provides general information about ERP payment systems and should not be considered financial or legal advice. It is essential to consult with qualified professionals to determine the best course of action for your specific business needs.

.

.