Navigating the Labyrinth of Risk: A Comprehensive Guide to Enterprise Risk Software

.

.

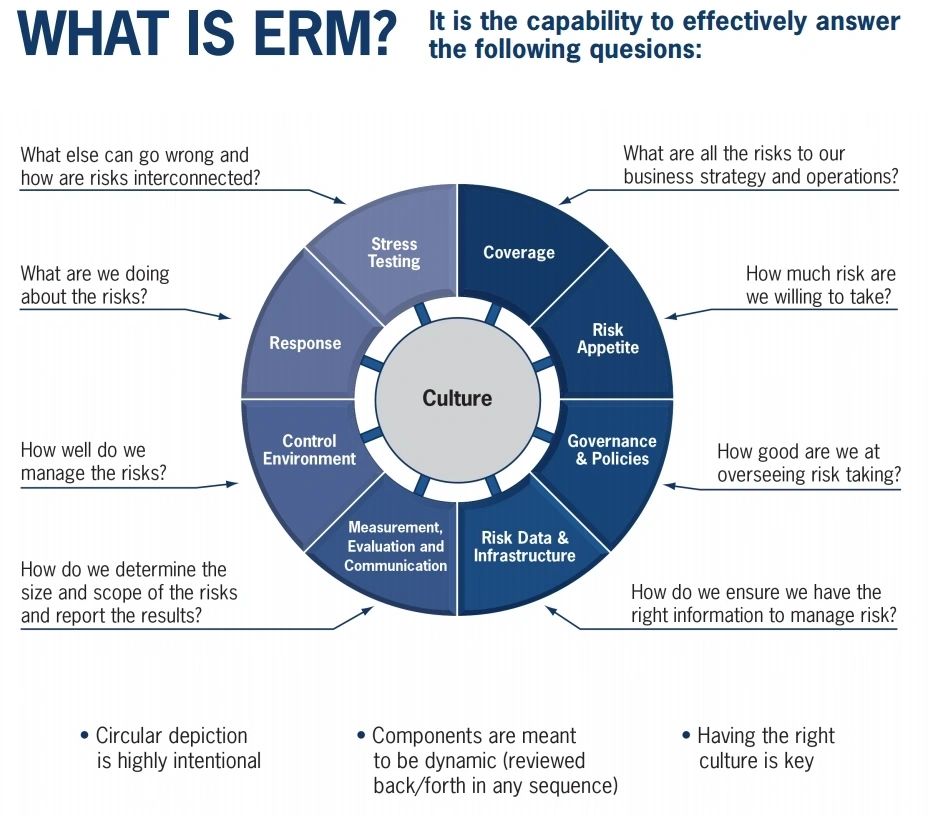

Welcome, fellow risk managers and business leaders! In today’s volatile and interconnected world, navigating the complex landscape of risk is no longer a luxury, but a necessity. From cyber threats and regulatory changes to economic downturns and supply chain disruptions, businesses face a constant barrage of potential hazards.

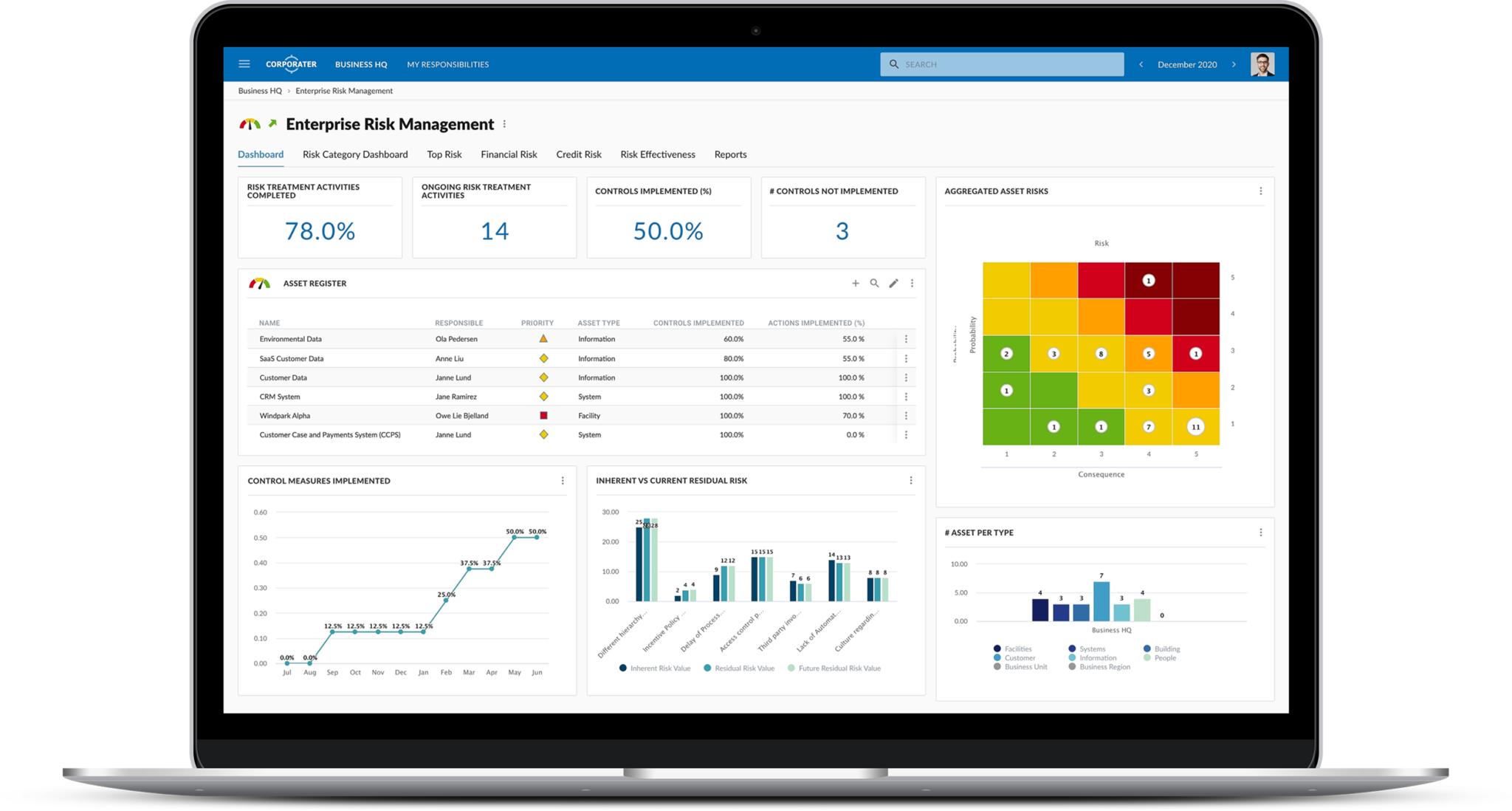

Enter enterprise risk software, a powerful tool that empowers organizations to identify, assess, manage, and mitigate risks effectively. This comprehensive guide will delve into the intricacies of enterprise risk software, uncovering its potential to transform your risk management approach and bolster your organization’s resilience.

Imagine a world where risk identification isn’t a daunting, manual process, but a seamless, automated journey. Enterprise risk software empowers organizations to proactively identify and assess risks across all facets of their operations. By leveraging advanced analytics and machine learning algorithms, these software solutions can analyze vast datasets, identify emerging threats, and predict potential vulnerabilities. This proactive approach allows organizations to stay ahead of the curve, mitigating risks before they escalate into significant problems.

But the benefits of enterprise risk software extend far beyond mere identification. These solutions offer a comprehensive framework for risk assessment, allowing organizations to prioritize risks based on their potential impact and likelihood of occurrence. This structured approach ensures that resources are allocated strategically, focusing on the most critical risks that could jeopardize business continuity.

.

.

Furthermore, enterprise risk software facilitates seamless collaboration and communication among stakeholders. By centralizing risk information and providing real-time updates, these solutions break down silos and foster a culture of shared responsibility for risk management. This collaborative approach ensures that all relevant parties are informed, engaged, and aligned on risk mitigation strategies.

Beyond its role in risk identification and assessment, enterprise risk software provides a robust platform for risk mitigation planning and execution. These solutions offer a range of tools, including risk registers, mitigation plans, and communication templates, to help organizations develop and implement effective risk mitigation strategies. By automating key processes and providing a centralized repository for risk-related information, enterprise risk software streamlines risk management operations, freeing up valuable time and resources.

However, the true power of enterprise risk software lies in its ability to provide actionable insights and real-time monitoring. By analyzing historical data and tracking current trends, these solutions can identify emerging risks and predict potential future threats. This proactive approach allows organizations to adjust their risk mitigation strategies dynamically, ensuring they remain resilient in the face of evolving challenges.

Ultimately, enterprise risk software is not just a tool, but a catalyst for transformation. By empowering organizations to adopt a proactive, data-driven approach to risk management, these solutions foster a culture of resilience and enable businesses to thrive in an increasingly uncertain world.

The Power of Enterprise Risk Software: Unveiling its Potential

1. A Holistic Risk Management Approach: Embracing Comprehensive Risk Coverage

.

.

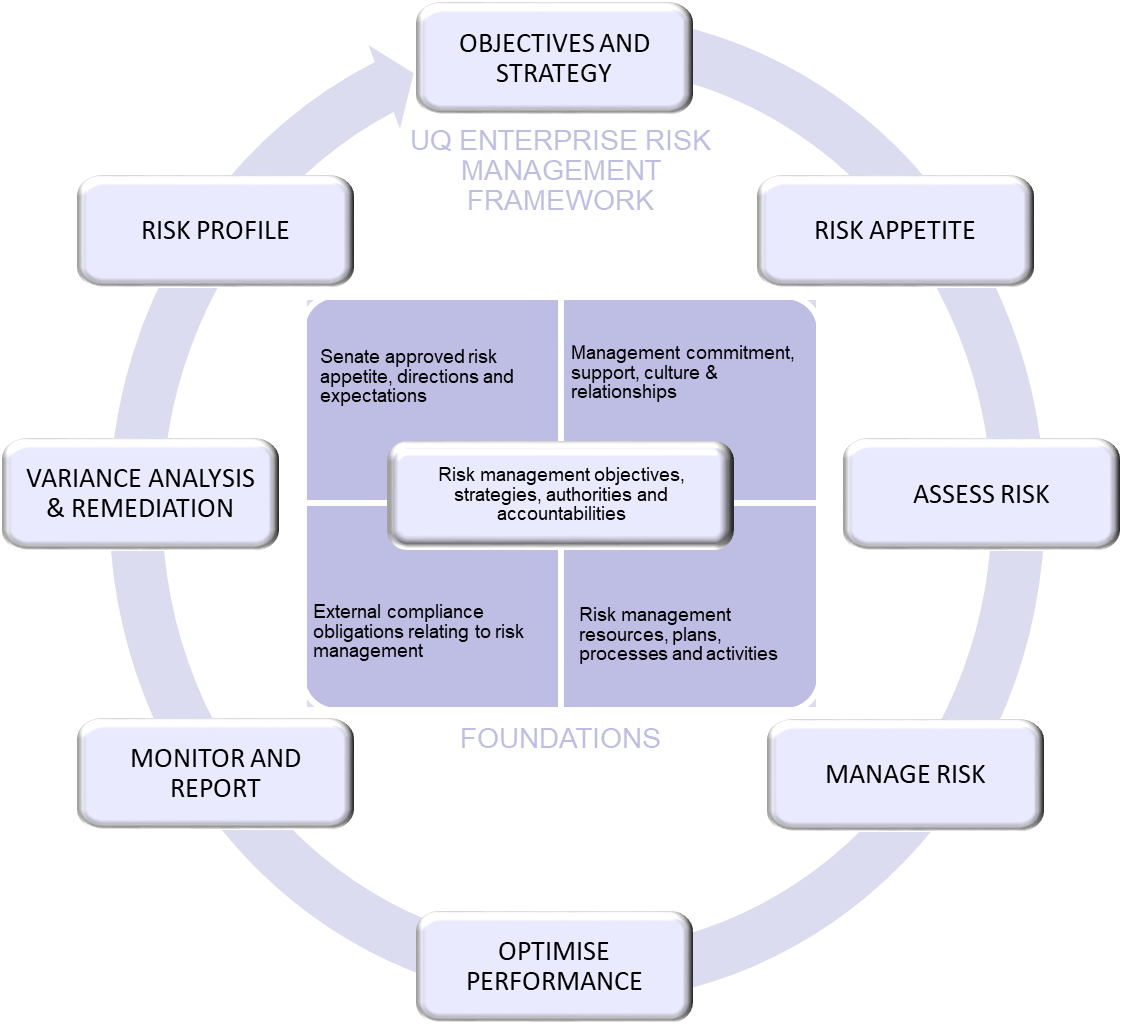

Enterprise risk software goes beyond traditional risk management frameworks, offering a holistic approach that encompasses all facets of an organization’s operations. Unlike siloed risk management practices, which focus on specific areas like financial or operational risks, enterprise risk software provides a unified platform for identifying, assessing, and mitigating risks across the entire business ecosystem.

This comprehensive approach ensures that organizations are not blindsided by unforeseen risks lurking in seemingly unrelated areas. By integrating data from various departments and sources, enterprise risk software paints a complete picture of the organization’s risk landscape, enabling proactive risk mitigation strategies.

Imagine a scenario where a manufacturing company faces a potential supply chain disruption due to a natural disaster in a key supplier’s region. A traditional risk management system focused solely on financial risks might miss this critical threat. However, enterprise risk software, with its holistic perspective, would identify this potential disruption, allowing the company to implement contingency plans and secure alternative suppliers, mitigating the impact on production and revenue.

2. Data-Driven Risk Assessment: Leveraging Analytics for Smarter Decisions

Gone are the days of relying on subjective intuition and anecdotal evidence for risk assessment. Enterprise risk software empowers organizations to make data-driven decisions, leveraging advanced analytics and machine learning algorithms to gain deeper insights into their risk landscape.

.

.

By analyzing historical data, market trends, and external factors, these solutions can identify patterns and predict potential risks with greater accuracy. This data-driven approach eliminates the biases and limitations associated with human judgment, providing a more objective and reliable assessment of risk.

For instance, an insurance company using enterprise risk software can analyze historical claims data to identify patterns and predict potential future claims. This data-driven approach allows them to adjust pricing models, allocate resources more effectively, and proactively manage potential risks, ultimately improving profitability and customer satisfaction.

3. Real-Time Risk Monitoring: Staying Ahead of the Curve

The world of risk is constantly evolving, with new threats emerging and existing ones morphing into unforeseen challenges. Enterprise risk software provides real-time risk monitoring capabilities, enabling organizations to stay ahead of the curve and respond swiftly to emerging risks.

These solutions leverage data feeds from various sources, including internal systems, external news feeds, and social media platforms, to track potential risks and provide instant alerts when threats arise. This real-time monitoring allows organizations to react quickly, implement mitigation strategies, and minimize the impact of emerging risks.

.

.

Imagine a scenario where a multinational company faces a potential cyberattack. Enterprise risk software, with its real-time monitoring capabilities, would detect the attack early on, triggering automated security protocols and notifying relevant stakeholders. This proactive approach would minimize the damage caused by the attack, protecting sensitive data and ensuring business continuity.

4. Streamlined Risk Management Processes: Optimizing Efficiency and Productivity

Manual risk management processes are often time-consuming, prone to errors, and lack the agility required to respond effectively to evolving risks. Enterprise risk software streamlines risk management processes, automating key tasks and centralizing risk information, freeing up valuable time and resources.

By automating tasks like risk identification, assessment, and reporting, these solutions enable risk managers to focus on strategic initiatives, such as developing effective mitigation plans and fostering a culture of risk awareness. This streamlined approach not only improves efficiency but also enhances accuracy and consistency, ensuring that risk management practices are standardized across the organization.

For example, a financial institution using enterprise risk software can automate the process of generating risk reports, eliminating the need for manual data entry and reducing the risk of errors. This automation allows risk managers to spend more time analyzing data, identifying emerging threats, and developing proactive risk mitigation strategies.

.

.

5. Collaborative Risk Management: Fostering Shared Responsibility and Alignment

Risk management is not a solitary endeavor. It requires the involvement and collaboration of stakeholders across all departments and levels of the organization. Enterprise risk software facilitates seamless communication and collaboration, fostering a shared understanding of risk and promoting a culture of risk awareness.

By centralizing risk information and providing real-time updates, these solutions break down silos and enable stakeholders to work together effectively. This collaborative approach ensures that all relevant parties are informed, engaged, and aligned on risk mitigation strategies, minimizing the risk of miscommunication and ensuring a cohesive response to emerging threats.

Imagine a scenario where a healthcare provider faces a potential data breach. Enterprise risk software, with its collaborative features, would enable the IT department, legal team, and patient relations team to work together seamlessly, sharing information, coordinating responses, and minimizing the impact of the breach.

6. Enhanced Reporting and Communication: Providing Clear Visibility and Accountability

Effective risk management requires clear and concise reporting, enabling stakeholders to understand the organization’s risk landscape and the effectiveness of mitigation strategies. Enterprise risk software provides powerful reporting capabilities, generating comprehensive reports that highlight key risks, mitigation plans, and performance metrics.

These reports can be customized to meet the specific needs of different stakeholders, providing a clear and concise overview of the organization’s risk profile. This enhanced reporting fosters transparency and accountability, ensuring that everyone is informed about the organization’s risk posture and the progress made in mitigating risks.

For instance, a retail company using enterprise risk software can generate reports that track the effectiveness of its fraud prevention measures, providing insights into the number of fraudulent transactions detected, the cost of fraud prevention, and the impact on customer experience. This data-driven approach allows the company to identify areas for improvement and optimize its fraud prevention strategies.

7. Continuous Improvement: Embracing a Culture of Risk Management

Enterprise risk software is not a static solution; it’s a dynamic platform that enables continuous improvement. By tracking risk events, analyzing performance metrics, and gathering feedback from stakeholders, organizations can continuously refine their risk management processes and adapt to evolving challenges.

These solutions provide a framework for identifying areas for improvement, implementing best practices, and fostering a culture of risk awareness throughout the organization. This continuous improvement cycle ensures that risk management remains relevant and effective, enabling organizations to navigate the ever-changing landscape of risk with confidence.

For example, a manufacturing company using enterprise risk software can track the effectiveness of its supply chain risk mitigation strategies, identifying areas where improvements can be made. This data-driven approach allows the company to optimize its supply chain, minimize disruptions, and ensure the continuity of its operations.

The Advantages and Disadvantages of Enterprise Risk Software: A Balanced Perspective

While enterprise risk software offers a plethora of benefits for organizations seeking to strengthen their risk management capabilities, it’s essential to acknowledge both its advantages and disadvantages to make an informed decision.

Advantages of Enterprise Risk Software:

- Comprehensive Risk Coverage: Enterprise risk software provides a holistic approach to risk management, encompassing all facets of an organization’s operations, ensuring no risk is overlooked.

- Data-Driven Insights: These solutions leverage advanced analytics and machine learning to gain deeper insights into risk patterns and predict potential threats, enabling data-driven decision-making.

- Real-Time Monitoring: Enterprise risk software enables organizations to stay ahead of the curve by providing real-time risk monitoring capabilities, allowing for swift responses to emerging threats.

- Streamlined Processes: Automation of key tasks and centralized risk information streamline risk management processes, improving efficiency and freeing up valuable resources.

- Collaborative Environment: Enterprise risk software facilitates seamless communication and collaboration among stakeholders, fostering a shared understanding of risk and promoting a culture of risk awareness.

- Enhanced Reporting and Communication: Powerful reporting capabilities provide clear visibility into the organization’s risk landscape and the effectiveness of mitigation strategies, fostering transparency and accountability.

- Continuous Improvement: Enterprise risk software enables organizations to continuously refine their risk management processes and adapt to evolving challenges, fostering a culture of risk management.

Disadvantages of Enterprise Risk Software:

- Implementation Complexity: Implementing enterprise risk software can be complex, requiring significant time, effort, and resources to configure and integrate the solution with existing systems.

- High Initial Costs: Enterprise risk software solutions can be expensive, with significant upfront costs for licensing, implementation, and ongoing maintenance.

- Data Security Concerns: Organizations must ensure that sensitive risk data is securely stored and protected from unauthorized access, requiring robust security measures and compliance with data privacy regulations.

- Potential for Over-Reliance: Over-reliance on enterprise risk software can lead to a lack of critical thinking and a diminished understanding of the underlying risks, potentially hindering effective risk mitigation.

- Limited Human Interaction: While enterprise risk software automates many tasks, it’s crucial to maintain human oversight and judgment to ensure that the software’s outputs are interpreted correctly and that critical decisions are made with a holistic understanding of the risks involved.

- Lack of Customization: Some enterprise risk software solutions may lack the flexibility to be customized to meet the specific needs of individual organizations, potentially limiting their effectiveness.

- Integration Challenges: Integrating enterprise risk software with existing systems can be challenging, requiring careful planning and coordination to ensure seamless data flow and avoid compatibility issues.

Understanding the Essentials of Enterprise Risk Software: A Comprehensive Overview

Enterprise risk software is a powerful tool that empowers organizations to identify, assess, manage, and mitigate risks effectively. These solutions offer a range of features and capabilities designed to streamline risk management processes, enhance decision-making, and improve overall organizational resilience.

Key Features of Enterprise Risk Software:

- Risk Identification: Enterprise risk software utilizes advanced analytics and machine learning algorithms to identify potential risks across all facets of an organization’s operations, including financial, operational, strategic, compliance, and reputational risks.

- Risk Assessment: These solutions provide a framework for assessing the severity and likelihood of identified risks, enabling organizations to prioritize risks based on their potential impact and likelihood of occurrence.

- Risk Mitigation Planning: Enterprise risk software offers tools for developing and implementing effective risk mitigation strategies, including risk registers, mitigation plans, and communication templates.

- Risk Monitoring and Reporting: Real-time risk monitoring capabilities allow organizations to track emerging threats and provide instant alerts when risks arise. Comprehensive reporting features provide clear visibility into the organization’s risk landscape and the effectiveness of mitigation strategies.

- Collaboration and Communication: Enterprise risk software facilitates seamless communication and collaboration among stakeholders, fostering a shared understanding of risk and promoting a culture of risk awareness.

- Integration with Existing Systems: Enterprise risk software can be integrated with existing systems, such as ERP, CRM, and financial systems, to provide a comprehensive view of the organization’s risk profile.

- Customization and Flexibility: Many enterprise risk software solutions offer customization options to tailor the software to meet the specific needs of individual organizations.

Benefits of Using Enterprise Risk Software:

- Improved Risk Management: Enterprise risk software enables organizations to adopt a proactive, data-driven approach to risk management, enhancing their ability to identify, assess, and mitigate risks effectively.

- Enhanced Decision-Making: Data-driven insights and real-time monitoring capabilities empower organizations to make more informed and strategic decisions regarding risk management.

- Increased Efficiency and Productivity: Automation of key tasks and streamlined processes free up valuable time and resources, enabling risk managers to focus on strategic initiatives.

- Improved Communication and Collaboration: Enterprise risk software fosters a culture of shared responsibility for risk management, enabling stakeholders to work together effectively to mitigate risks.

- Enhanced Transparency and Accountability: Comprehensive reporting capabilities provide clear visibility into the organization’s risk landscape and the effectiveness of mitigation strategies, fostering transparency and accountability.

- Continuous Improvement: Enterprise risk software enables organizations to continuously refine their risk management processes and adapt to evolving challenges, fostering a culture of risk management.

Types of Enterprise Risk Software:

- Risk Management Information Systems (RMIS): RMIS solutions are designed to manage and track insurance claims and other risk-related data.

- Risk Assessment Software: These solutions focus on identifying and assessing risks, providing tools for risk analysis, scoring, and prioritization.

- Risk Mitigation Software: Risk mitigation software provides tools for developing and implementing effective risk mitigation strategies, including risk registers, mitigation plans, and communication templates.

- Compliance Management Software: Compliance management software helps organizations manage their compliance obligations, ensuring adherence to relevant regulations and industry standards.

- Cybersecurity Software: Cybersecurity software provides tools for protecting against cyber threats, including firewalls, intrusion detection systems, and antivirus software.

Navigating the Labyrinth of Enterprise Risk Software: A Guide to Choosing the Right Solution

Selecting the right enterprise risk software solution is crucial for achieving optimal risk management outcomes. Here’s a comprehensive guide to help you navigate the labyrinth of options and choose the solution that best meets your organization’s specific needs:

1. Define Your Requirements: Identifying Your Needs and Objectives

Before embarking on your search for enterprise risk software, it’s essential to define your specific requirements and objectives. Consider the following factors:

- Risk Management Framework: What is your organization’s current risk management framework, and how does it align with your business objectives?

- Risk Appetite: What level of risk is your organization willing to accept?

- Risk Tolerance: What level of risk is your organization comfortable with?

- Risk Culture: What is the current risk culture within your organization, and how can enterprise risk software help foster a more proactive and data-driven approach?

- Data Requirements: What data sources need to be integrated with the enterprise risk software, and what level of data security is required?

- Reporting Needs: What types of reports are required, and who are the intended recipients?

- Budget and Resources: What is your budget for enterprise risk software, and what resources are available for implementation and ongoing maintenance?

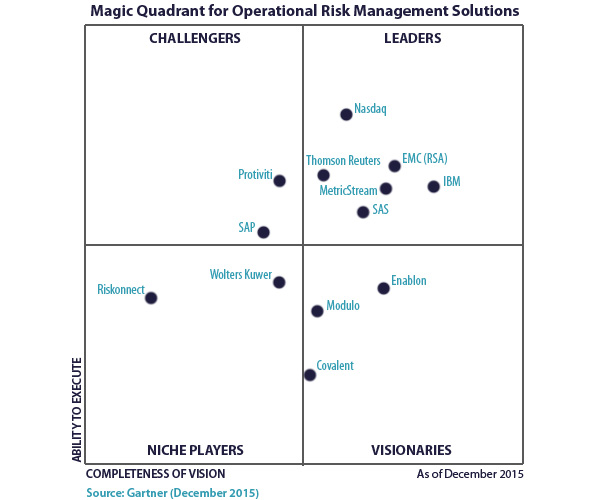

2. Research and Compare Solutions: Evaluating Options and Finding the Best Fit

Once you have a clear understanding of your requirements, it’s time to research and compare different enterprise risk software solutions. Consider the following factors:

- Features and Functionality: Ensure that the software offers the features and functionality needed to meet your specific requirements, including risk identification, assessment, mitigation planning, monitoring, reporting, and collaboration.

- Industry Focus: Some enterprise risk software solutions are tailored to specific industries, such as financial services, healthcare, or manufacturing. Choose a solution that aligns with your industry and addresses your unique risk challenges.

- Scalability and Flexibility: Ensure that the software can scale to meet your organization’s evolving needs and can be customized to meet your specific requirements.

- Integration Capabilities: Assess the software’s integration capabilities with your existing systems, ensuring seamless data flow and avoiding compatibility issues.

- User Interface and Usability: The software should have a user-friendly interface that is easy to navigate and understand, enabling all stakeholders to use the solution effectively.

- Customer Support: Evaluate the software vendor’s customer support services, including availability, responsiveness, and technical expertise.

- Pricing and Licensing: Compare pricing models and licensing options, ensuring that the solution fits within your budget and meets your organization’s needs.

3. Conduct Proof-of-Concept (POC): Testing and Validating the Solution

Before making a final decision, conduct a proof-of-concept (POC) to test the software’s functionality and ensure it meets your requirements. This involves:

- Data Integration: Integrate the software with your existing systems and test the data flow to ensure accurate and timely data capture.

- Functionality Testing: Test the software’s key features, including risk identification, assessment, mitigation planning, monitoring, and reporting.

- User Acceptance Testing (UAT): Involve key stakeholders in UAT to ensure that the software is user-friendly and meets their needs.

- Performance Evaluation: Evaluate the software’s performance, including speed, reliability, and scalability.

4. Implement and Integrate: Setting Up and Optimizing the Solution

Once you’ve chosen the right enterprise risk software solution, it’s time to implement and integrate it into your organization. This involves:

- Project Planning: Develop a detailed project plan that outlines the implementation timeline, resources, and responsibilities.

- Configuration and Customization: Configure the software to meet your organization’s specific requirements, including data fields, workflows, and reporting templates.

- User Training: Provide comprehensive user training to ensure that all stakeholders understand how to use the software effectively.

- Data Migration: Migrate existing risk data into the new system, ensuring data accuracy and consistency.

- Integration with Existing Systems: Integrate the software with your existing systems, ensuring seamless data flow and avoiding compatibility issues.

5. Ongoing Monitoring and Optimization: Maintaining and Improving the Solution

After implementation, it’s crucial to continuously monitor and optimize the enterprise risk software solution to ensure its effectiveness and maximize its value. This involves:

- Performance Monitoring: Track the software’s performance, including speed, reliability, and scalability, to identify any issues or areas for improvement.

- User Feedback: Gather feedback from stakeholders to identify areas where the software can be improved or customized to better meet their needs.

- Data Analysis: Analyze the data collected by the software to identify emerging trends, potential risks, and areas for improvement in risk management practices.

- Regular Updates and Upgrades: Ensure that the software is kept up-to-date with regular updates and upgrades to ensure optimal performance, security, and compliance.

Frequently Asked Questions about Enterprise Risk Software: Addressing Common Concerns

1. What are the key benefits of using enterprise risk software?

Enterprise risk software offers a multitude of benefits, including improved risk management, enhanced decision-making, increased efficiency and productivity, improved communication and collaboration, enhanced transparency and accountability, and continuous improvement.

2. How can enterprise risk software help my organization manage cyber risks?

Enterprise risk software can help organizations manage cyber risks by providing tools for identifying potential vulnerabilities, assessing the likelihood and impact of cyberattacks, developing and implementing mitigation strategies, and monitoring for suspicious activity.

3. What are the common challenges associated with implementing enterprise risk software?

Common challenges include implementation complexity, high initial costs, data security concerns, potential for over-reliance on the software, limited human interaction, lack of customization, and integration challenges.

4. How can I choose the right enterprise risk software solution for my organization?

Start by defining your requirements and objectives, research and compare different solutions, conduct a proof-of-concept, implement and integrate the solution, and continuously monitor and optimize it.

5. What are the key factors to consider when evaluating enterprise risk software solutions?

Consider features and functionality, industry focus, scalability and flexibility, integration capabilities, user interface and usability, customer support, and pricing and licensing.

6. How can I ensure that my organization’s sensitive data is secure when using enterprise risk software?

Implement robust security measures, including data encryption, access control, and regular security audits. Ensure compliance with relevant data privacy regulations, such as GDPR and CCPA.

7. How can I prevent over-reliance on enterprise risk software?

Maintain human oversight and judgment, ensuring that the software’s outputs are interpreted correctly and that critical decisions are made with a holistic understanding of the risks involved.

8. How can I integrate enterprise risk software with my existing systems?

Work with the software vendor and your IT team to develop a seamless integration plan, ensuring that data flows smoothly between systems and avoiding compatibility issues.

9. How can I train my employees to use enterprise risk software effectively?

Provide comprehensive user training, including hands-on demonstrations, interactive exercises, and ongoing support.

10. How can I measure the return on investment (ROI) of enterprise risk software?

Track key performance indicators (KPIs), such as the number of risks identified, the cost of risk mitigation, and the impact of risk events on the organization’s operations.

11. What are the latest trends in enterprise risk software?

Trends include the integration of artificial intelligence (AI) and machine learning, the use of cloud-based solutions, and the increasing focus on data privacy and security.

12. How can enterprise risk software help my organization comply with regulatory requirements?

Enterprise risk software can help organizations comply with regulatory requirements by providing tools for identifying and assessing compliance risks, developing and implementing mitigation strategies, and tracking compliance progress.

13. What are the best practices for using enterprise risk software effectively?

Define clear requirements and objectives, choose the right solution, implement and integrate it properly, continuously monitor and optimize it, and foster a culture of risk awareness throughout the organization.

Embracing the Future of Risk Management: A Call to Action

The future of risk management is data-driven, collaborative, and agile. Enterprise risk software is not just a tool, but a catalyst for transformation, enabling organizations to navigate the ever-changing landscape of risk with confidence.

By embracing enterprise risk software, organizations can:

- Proactively identify and assess risks: Stay ahead of the curve by leveraging advanced analytics and machine learning to identify potential threats before they materialize.

- Develop and implement effective mitigation strategies: Ensure that risks are mitigated effectively through robust planning, execution, and monitoring.

- Foster a culture of risk awareness: Promote shared responsibility for risk management and empower stakeholders to make informed decisions.

- Continuously improve risk management practices: Adapt to evolving challenges and refine risk management processes to ensure ongoing effectiveness.

The time to act is now. Don’t let risk management remain a reactive, manual process. Embrace the power of enterprise risk software and transform your organization into a resilient, data-driven powerhouse.

Disclaimer: This article is intended for informational purposes only and does not constitute financial, legal, or other professional advice. The information provided should not be considered a substitute for consulting with qualified professionals.

.

.