ERP Banking: A Comprehensive Guide to Streamlining Financial Operations

Introduction

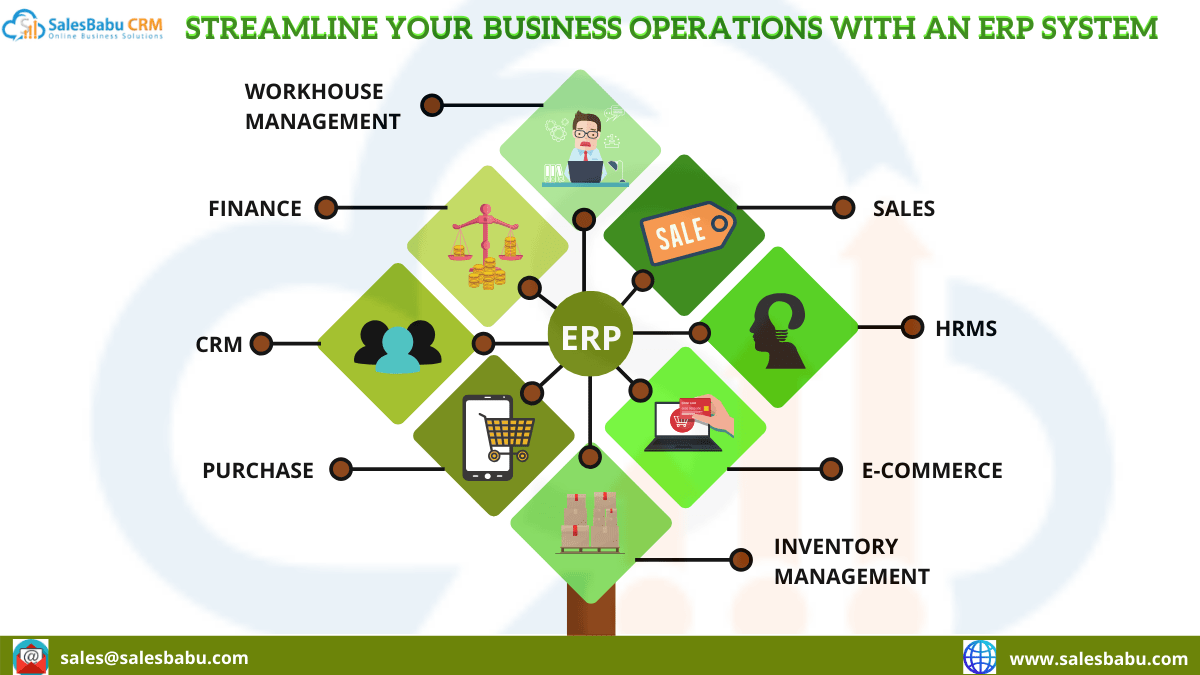

The banking industry is undergoing a transformative shift, driven by the advent of advanced technologies. One such technology that has gained significant traction is Enterprise Resource Planning (ERP) software. ERP systems are designed to integrate and streamline various business processes across an organization, including financial management, supply chain management, and customer relationship management. In the banking sector, ERP systems have emerged as a powerful tool for enhancing operational efficiency, reducing costs, and improving customer service.

This comprehensive guide will delve into the world of ERP banking, exploring its key benefits, addressing potential challenges, and providing insights into how banks can leverage ERP systems to gain a competitive edge.

Understanding ERP Banking

ERP banking refers to the implementation of ERP software specifically designed for the banking industry. These systems provide a centralized platform that integrates and automates core banking processes, such as:

- Account management: Managing customer accounts, including account opening, closing, and transaction processing.

- Loan management: Processing loan applications, tracking loan payments, and managing loan portfolios.

- Deposit management: Managing deposits, calculating interest, and providing account statements.

- Payment processing: Facilitating various payment methods, including electronic funds transfer, wire transfer, and check processing.

- Financial reporting: Generating financial statements, such as balance sheets, income statements, and cash flow statements.

By integrating these processes onto a single platform, ERP systems eliminate data silos, reduce manual errors, and provide banks with a comprehensive view of their operations.

Benefits of ERP Banking

The implementation of ERP systems in banking institutions offers numerous benefits, including:

- Improved operational efficiency: Automation of manual processes streamlines operations, reduces processing times, and enhances overall efficiency.

- Reduced costs: Automation eliminates the need for manual labor, reducing operational costs and improving profitability.

- Enhanced customer service: Integrated systems provide a unified view of customer data, enabling banks to deliver personalized and efficient services.

- Increased accuracy: Automation reduces manual errors, ensuring the accuracy and reliability of financial data.

- Improved compliance: ERP systems facilitate compliance with regulatory requirements, such as Basel III and IFRS.

- Enhanced decision-making: Real-time data and analytics capabilities provide insights for informed decision-making.

- Competitive advantage: ERP systems enable banks to differentiate themselves by offering innovative and value-added services.

Challenges of ERP Banking

While ERP systems offer significant benefits, their implementation can also pose challenges, including:

- High implementation costs: ERP systems require significant investment in hardware, software, and implementation services.

- Complexity of implementation: Implementing ERP systems can be complex and time-consuming, requiring careful planning and execution.

- Data migration: Migrating data from legacy systems to ERP systems can be challenging, especially for large banks with complex data structures.

- Resistance to change: Employees may resist changes to established processes, making it crucial for banks to manage change effectively.

- Integration with legacy systems: ERP systems may need to integrate with existing legacy systems, which can be complex and costly.

ERP Banking for Ideal Customer Personas

ERP systems are particularly beneficial for banks that:

- Seek to improve operational efficiency: Banks with manual or fragmented processes can significantly benefit from the automation and integration offered by ERP systems.

- Aim to reduce costs: Banks facing cost pressures can leverage ERP systems to streamline operations and reduce expenses.

- Prioritize customer service: Banks that value customer satisfaction can use ERP systems to provide personalized and efficient services.

- Need to enhance compliance: Banks operating in regulated environments can use ERP systems to facilitate compliance with regulatory requirements.

- Aspire to gain a competitive advantage: Banks seeking to differentiate themselves can use ERP systems to offer innovative and value-added services.

Advantages and Disadvantages of ERP Banking

Advantages

- Improved operational efficiency: ERP systems automate manual processes, reduce processing times, and enhance overall efficiency.

- Reduced costs: Automation eliminates the need for manual labor, reducing operational costs and improving profitability.

- Enhanced customer service: Integrated systems provide a unified view of customer data, enabling banks to deliver personalized and efficient services.

- Increased accuracy: Automation reduces manual errors, ensuring the accuracy and reliability of financial data.

- Improved compliance: ERP systems facilitate compliance with regulatory requirements, such as Basel III and IFRS.

- Enhanced decision-making: Real-time data and analytics capabilities provide insights for informed decision-making.

- Competitive advantage: ERP systems enable banks to differentiate themselves by offering innovative and value-added services.

Disadvantages

- High implementation costs: ERP systems require significant investment in hardware, software, and implementation services.

- Complexity of implementation: Implementing ERP systems can be complex and time-consuming, requiring careful planning and execution.

- Data migration: Migrating data from legacy systems to ERP systems can be challenging, especially for large banks with complex data structures.

- Resistance to change: Employees may resist changes to established processes, making it crucial for banks to manage change effectively.

- Integration with legacy systems: ERP systems may need to integrate with existing legacy systems, which can be complex and costly.

Summary of ERP Banking

ERP banking involves the implementation of ERP software specifically designed for the banking industry. These systems integrate and automate core banking processes, providing banks with a centralized platform for managing their operations. ERP systems offer numerous benefits, including improved operational efficiency, reduced costs, enhanced customer service, increased accuracy, improved compliance, and enhanced decision-making. However, banks need to carefully consider the potential challenges, such as high implementation costs, complexity of implementation, data migration, resistance to change, and integration with legacy systems. ERP systems are particularly beneficial for banks seeking to improve operational efficiency, reduce costs, prioritize customer service, enhance compliance, and gain a competitive advantage.

Q&A

-

Q: What are the key benefits of ERP banking?

-

A: Improved operational efficiency, reduced costs, enhanced customer service, increased accuracy, improved compliance, enhanced decision-making, and competitive advantage.

-

Q: What are the challenges of ERP banking?

-

A: High implementation costs, complexity of implementation, data migration, resistance to change, and integration with legacy systems.

-

Q: Who are the ideal customer personas for ERP banking?

-

A: Banks seeking to improve operational efficiency, reduce costs, prioritize customer service, enhance compliance, and gain a competitive advantage.

-

Q: What are the advantages of ERP banking?

-

A: Improved operational efficiency, reduced costs, enhanced customer service, increased accuracy, improved compliance, enhanced decision-making, and competitive advantage.

-

Q: What are the disadvantages of ERP banking?

-

A: High implementation costs, complexity of implementation, data migration, resistance to change, and integration with legacy systems.

-

Q: How can banks overcome the challenges of ERP banking?

-

A: Careful planning, phased implementation, effective change management, and strategic integration with legacy systems.

-

Q: What are the key considerations for banks when implementing ERP systems?

-

A: Business requirements, budget, timeline, resources, and vendor selection.

-

Q: How can banks ensure a successful ERP implementation?

-

A: Strong leadership, clear communication, user training, and ongoing support.

-

Q: What are the emerging trends in ERP banking?

-

A: Cloud-based ERP, mobile banking, and artificial intelligence-powered analytics.

-

Q: How can banks leverage ERP systems to gain a competitive advantage?

-

A: By offering innovative services, improving customer experience, and optimizing operations.

-

Q: What are the best practices for ERP banking?

-

A: Regular system updates, data security measures, and continuous process improvement.

-

Q: How can banks measure the ROI of ERP banking?

-

A: By tracking key performance indicators, such as operational efficiency, cost savings, and customer satisfaction.

-

Q: What are the future prospects of ERP banking?

-

A: Continued growth and adoption, driven by technological advancements and the increasing need for operational efficiency.

Conclusion

ERP banking has emerged as a transformative force in the banking industry, providing banks with the tools to streamline operations, reduce costs, enhance customer service, and gain a competitive advantage. By carefully considering the benefits, challenges, and best practices of ERP banking, banks can harness the power of technology to drive growth and success in the digital age.

Closing Statement

The implementation of ERP systems in the banking sector is not merely a technological upgrade but a strategic investment in the future of banking. By embracing ERP banking, banks can unlock a world of possibilities, empowering them to meet the evolving needs of their customers and navigate the ever-changing financial landscape.