In this auspicious occasion, we are delighted to delve into the intriguing topic related to Accounts Payable Software For Small Business: Unlocking Efficiency and Saving Time. Let’s weave interesting information and offer fresh perspectives to the readers.

Accounts Payable Software For Small Business: Unlocking Efficiency and Saving Time

The world of small businesses is a whirlwind of activity. From juggling sales and marketing to managing inventory and customer service, entrepreneurs wear many hats. One often-overlooked area that can significantly impact a business’s bottom line is accounts payable (AP).

The Accounts Payable Struggle: A Common Tale

Imagine this: You’re a small business owner, brimming with ideas and excited to grow your venture. You’re constantly on the go, juggling multiple tasks and wearing several hats. But amidst the hustle, a nagging problem lurks – managing accounts payable.

You find yourself:

- Drowning in paper invoices: A mountain of paper invoices piles up on your desk, each demanding attention. You spend hours manually entering data, chasing down missing information, and struggling to keep track of payment deadlines.

- Losing valuable time: The tedious process of manual AP consumes your precious time, time that could be spent on growing your business, developing new products, or connecting with customers.

- Prone to errors: With manual data entry, human error is inevitable. Missed deadlines, incorrect payments, and late fees can add up, impacting your cash flow and hurting your business’s reputation.

- Struggling with visibility: You lack a clear picture of your financial health. It’s difficult to track spending, identify potential savings, and make informed financial decisions.

Accounts Payable Software For Small Business: Unlocking Efficiency and Saving Time

The Solution: Embracing Accounts Payable Software

Thankfully, the days of wrestling with paper invoices and spreadsheets are over. Accounts Payable (AP) software offers a powerful solution, streamlining your AP process and liberating you from the time-consuming tasks that hold you back.

What is Accounts Payable Software?

Accounts Payable software is a digital tool designed to automate and simplify the entire AP process, from invoice receipt to payment. It centralizes your invoices, automates data entry, streamlines approval workflows, and provides real-time insights into your financial health.

Key Benefits of AP Software for Small Businesses:

1. Automation for Efficiency and Time Savings:

- Automated Invoice Processing: Say goodbye to manual data entry. AP software automatically extracts invoice data, eliminating the need for tedious typing and reducing the risk of errors.

- Automated Approval Workflows: Set up approval workflows based on your business needs. Invoices are automatically routed to the appropriate approvers, ensuring timely processing and eliminating bottlenecks.

- Automated Payment Processing: Schedule and automate payments, eliminating the need for manual checks and ensuring on-time payments.

2. Enhanced Accuracy and Reduced Errors:

- Data Validation and Error Detection: AP software uses advanced algorithms to validate invoice data, ensuring accuracy and preventing costly errors.

- Automated Payment Processing: Schedule and automate payments, eliminating the need for manual checks and ensuring on-time payments.

- Automated Duplicate Invoice Detection: The software can identify and flag duplicate invoices, preventing accidental double payments and saving you money.

3. Improved Visibility and Financial Control:

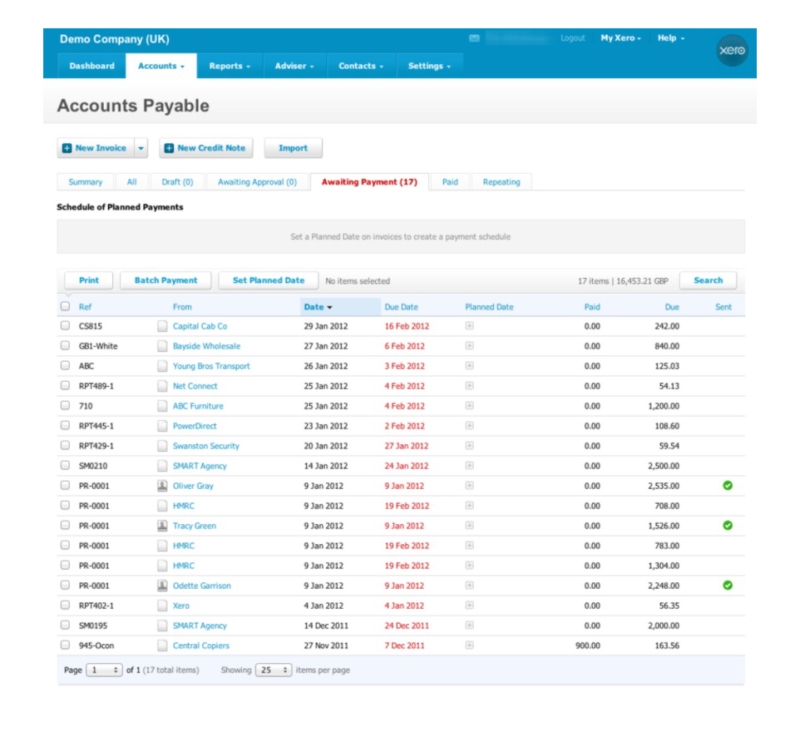

- Real-Time Reporting and Analytics: Gain instant access to comprehensive reports on your AP activity, including outstanding invoices, payment history, and spending trends.

- Centralized Invoice Management: All your invoices are stored securely in one central location, providing easy access and eliminating the need for paper files.

- Enhanced Cash Flow Management: Track your cash flow in real-time, identify potential savings, and make informed financial decisions.

Thus, we hope this article has provided valuable insights into Accounts Payable Software For Small Business: Unlocking Efficiency and Saving Time.

4. Streamlined Collaboration and Communication:

- Centralized Communication: All stakeholders can access and communicate about invoices in a single platform, eliminating confusion and delays.

- Improved Audit Trails: Track every step of the AP process, providing a clear audit trail for regulatory compliance and internal audits.

Choosing the Right AP Software for Your Business:

With so many AP software options available, choosing the right one for your business can seem daunting. Here are some key factors to consider:

- Ease of Use: Select software that is user-friendly and intuitive, even for non-technical users.

- Features and Functionality: Look for features that align with your specific business needs, such as automated invoice processing, approval workflows, and payment processing.

- Integration Capabilities: Ensure the software integrates seamlessly with your existing accounting software and other business systems.

- Scalability: Choose software that can grow with your business as your needs evolve.

- Cost and Pricing: Consider your budget and choose software with a pricing model that fits your needs.

Top Accounts Payable Software Solutions for Small Businesses:

- Zoho Invoice: A comprehensive invoicing and expense management solution with robust AP features, including automated invoice processing, approval workflows, and payment processing.

- Xero: A popular cloud-based accounting software with a user-friendly interface and powerful AP features, including invoice automation, payment reconciliation, and customizable reports.

- FreshBooks: A popular accounting software designed for small businesses, offering intuitive AP features, including invoice tracking, expense management, and automated payments.

- QuickBooks Online: A leading accounting software with a wide range of AP features, including automated invoice processing, payment reconciliation, and customizable reports.

- NetSuite: A comprehensive ERP solution that includes robust AP functionality, enabling businesses to automate their entire AP process, from invoice receipt to payment.

Implementing AP Software: A Smooth Transition

Implementing AP software can be a game-changer for your small business, but it’s important to approach the transition strategically. Here are some tips for a smooth implementation:

- Choose the Right Software: Carefully evaluate your needs and select software that aligns with your business requirements.

- Train Your Team: Provide thorough training to your team on the new software, ensuring they understand its features and functionality.

- Start Small: Begin by automating a few key processes, gradually expanding the scope of your AP automation as your team gains confidence.

- Seek Support: Don’t hesitate to reach out to the software provider’s support team for assistance during the implementation process.

The Impact of AP Automation: A Case Study

Let’s consider a fictional small business, "Creative Crafts," a thriving craft supply store.

- The Challenge: Creative Crafts was struggling with a manual AP process, leading to delays in payments, lost invoices, and inaccurate financial reporting.

- The Solution: They implemented Zoho Invoice, an AP software that automated their invoice processing, approval workflows, and payment processing.

- The Results: Creative Crafts experienced a significant improvement in their AP efficiency. They reduced their processing time by 50%, eliminated errors, and gained real-time visibility into their financial health.

Conclusion: Empowering Your Business with AP Automation

Accounts Payable software is not just a tool; it’s an investment in your business’s future. By automating your AP process, you can free up valuable time, reduce errors, improve financial visibility, and ultimately, focus on what matters most – growing your business.

Don’t let AP be a burden. Embrace the power of automation and unlock the potential for efficiency, accuracy, and growth in your small business.

We hope you find this article informative and beneficial. See you in our next article!