Unlocking Efficiency and Control: A Comprehensive Guide to Expense Management Software for Small Businesses

.

.

Are you a small business owner constantly grappling with a mountain of receipts, struggling to track your spending, and feeling overwhelmed by the sheer volume of financial data? You’re not alone. Many small business owners face these challenges, and they can significantly impact your bottom line. Fortunately, there’s a powerful solution: expense management software.

Expense management software is designed to streamline and simplify the process of tracking, managing, and reporting business expenses. It’s like having a dedicated financial assistant at your fingertips, automating tedious tasks and providing valuable insights into your spending habits. This software empowers you to gain better control over your finances, identify areas for cost savings, and make more informed business decisions.

But navigating the world of expense management software can feel daunting. With so many options available, choosing the right software for your specific needs can be a challenge. This comprehensive guide is here to demystify the process, providing you with the knowledge and insights you need to make an informed decision. We’ll explore the benefits and drawbacks of expense management software, delve into its key features, and guide you through selecting the best solution for your small business.

Let’s embark on this journey together and unlock the potential of efficient expense management for your business.

.

.

The Power of Automation: How Expense Management Software Streamlines Your Finances

Imagine a world where your expenses are automatically tracked, categorized, and reconciled, freeing you from the drudgery of manual data entry. This is the reality that expense management software offers. By leveraging automation, these powerful tools streamline your financial processes, saving you time and effort while reducing the risk of errors.

Here’s a glimpse into the transformative power of automation:

1. Effortless Expense Tracking: Say goodbye to the days of manually logging every receipt and struggling to keep track of your spending. With expense management software, you can effortlessly capture expenses through various methods, including:

* **Mobile App Integration:** Capture receipts on the go with your smartphone's camera.

* **Direct Bank Integration:** Automatically import transactions from your business bank accounts. .

* **Credit Card Integration:** Track expenses directly from your business credit cards.

.

* **Credit Card Integration:** Track expenses directly from your business credit cards.2. Automated Categorization and Reconciliation: No more painstakingly sorting through receipts and manually categorizing expenses. Expense management software utilizes advanced algorithms to automatically categorize your expenses, ensuring accuracy and consistency. This automation also simplifies reconciliation, as the software automatically matches expenses with your bank statements, minimizing discrepancies and saving you valuable time.

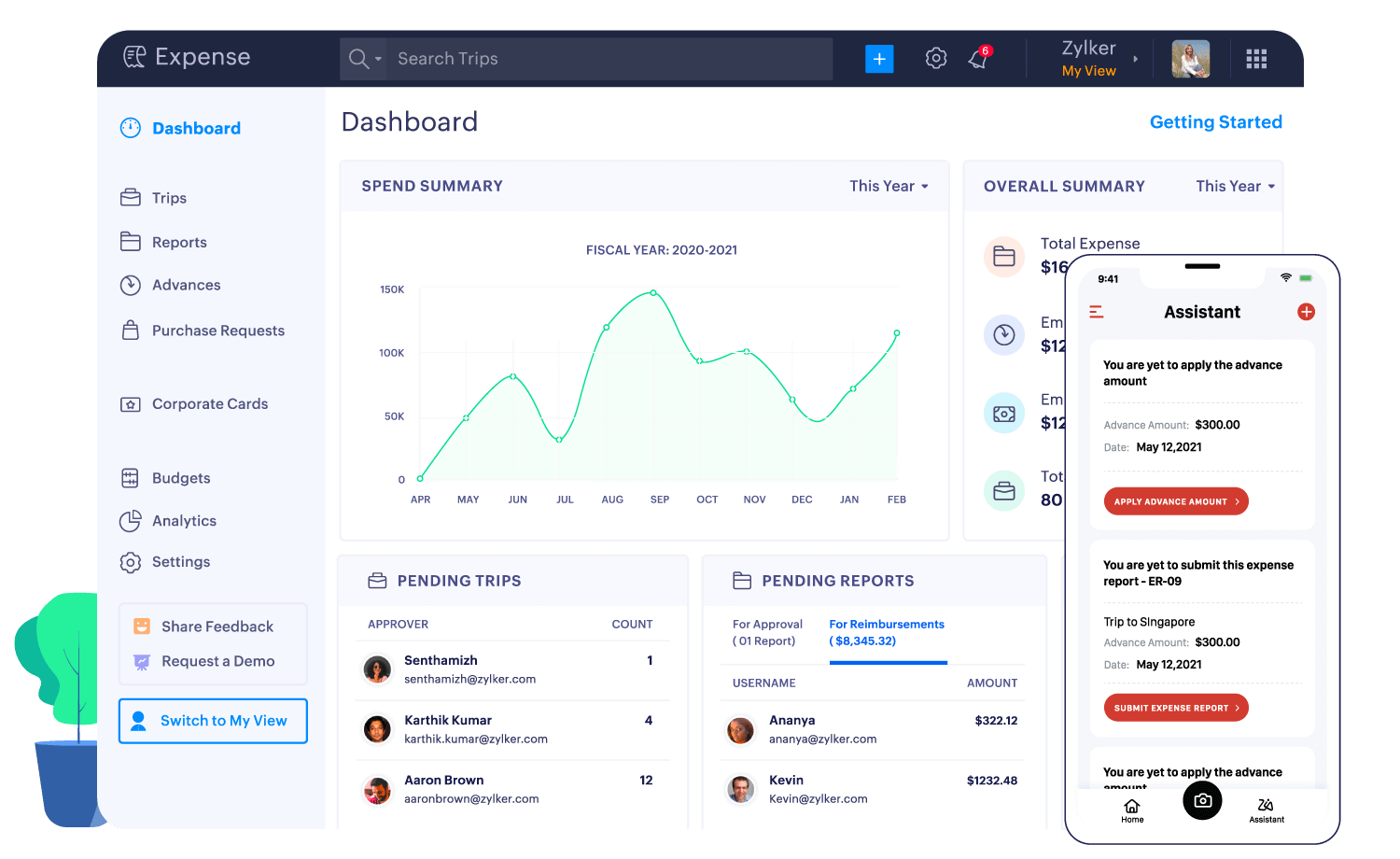

3. Real-Time Insights and Reporting: Gain instant visibility into your spending patterns with real-time dashboards and reports. Analyze your expenses by category, vendor, employee, or any other relevant criteria. This granular data empowers you to identify cost-saving opportunities, make informed budgeting decisions, and ensure compliance with tax regulations.

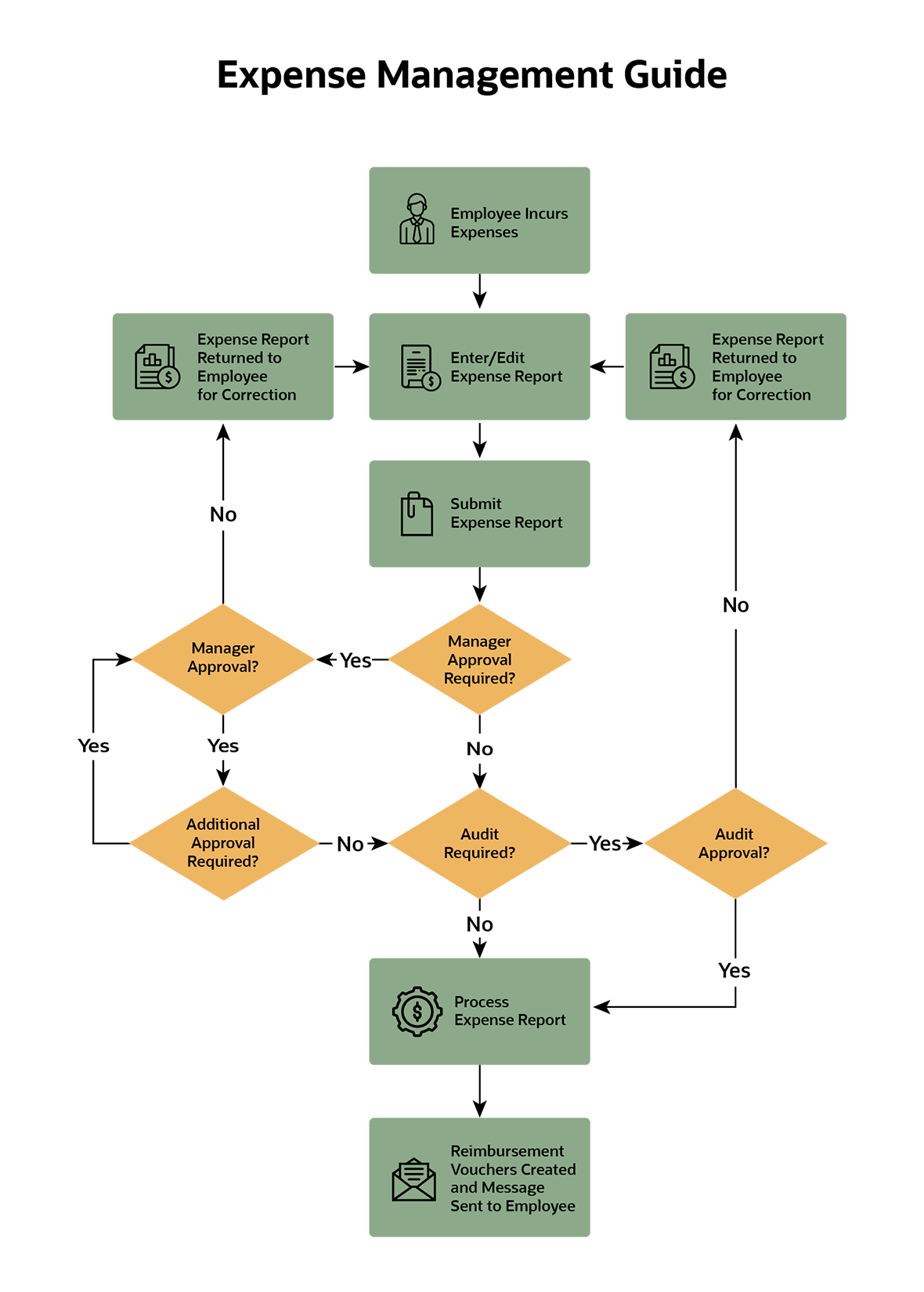

4. Enhanced Collaboration and Control: Expense management software fosters seamless collaboration between employees and managers. Employees can easily submit expense reports, while managers can approve or reject them with a few clicks. This centralized platform provides a clear audit trail, promoting transparency and accountability within your organization.

5. Improved Compliance and Audit Trail: Maintaining accurate records is crucial for tax compliance and audits. Expense management software ensures that all your expenses are documented and readily accessible, simplifying the audit process and minimizing the risk of penalties.

.

.

Beyond Automation: Exploring the Core Features of Expense Management Software

While automation is a cornerstone of expense management software, its capabilities extend far beyond simply tracking your expenses. These features empower you to gain deeper insights into your spending, make data-driven decisions, and optimize your financial processes.

1. Expense Reporting and Approval: Streamline the expense reporting process and gain greater control over employee spending. Employees can submit expense reports electronically, complete with receipts and supporting documentation. Managers can then review and approve these reports, ensuring compliance with company policies and budgets.

2. Budgeting and Forecasting: Set realistic budgets and track your progress against your financial goals. Expense management software provides powerful budgeting tools that allow you to allocate funds across different departments or projects. You can also leverage forecasting capabilities to predict future expenses and make informed financial planning decisions.

3. Customized Reporting and Analytics: Gain valuable insights into your spending patterns with customizable reports and analytics. Analyze expenses by category, vendor, employee, or any other relevant criteria. Identify trends, uncover cost-saving opportunities, and make data-driven decisions to optimize your financial performance.

.

.

4. Integration with Accounting Software: Seamlessly integrate your expense management software with your existing accounting system. This integration eliminates the need for manual data entry, ensuring consistency and accuracy across your financial records.

5. Mobile App Accessibility: Stay on top of your expenses from anywhere, anytime with a dedicated mobile app. Capture receipts, submit expense reports, and access real-time data, all from the convenience of your smartphone or tablet.

6. Security and Data Protection: Rest assured that your financial data is secure with robust security features. Expense management software utilizes encryption and other security measures to protect your sensitive information from unauthorized access.

7. Customer Support and Training: Receive dedicated customer support and training to ensure you’re getting the most out of your expense management software. Many providers offer comprehensive resources, including tutorials, webinars, and live chat support, to help you navigate the platform and maximize its benefits.

Unveiling the Advantages of Expense Management Software for Small Businesses

.

.

Implementing expense management software can be a game-changer for small businesses, offering numerous advantages that can significantly improve your financial health and streamline your operations.

1. Enhanced Financial Control and Visibility: Gain complete visibility into your spending patterns, enabling you to make informed financial decisions and optimize your cash flow. Identify areas where you can cut costs, allocate funds more effectively, and ensure that your business is operating within your budget.

2. Streamlined Expense Reporting and Approval: Simplify the expense reporting process, reducing the time and effort required for both employees and managers. Automate the approval process, ensuring that expenses are reviewed and approved promptly, minimizing delays and improving efficiency.

3. Improved Accuracy and Reduced Errors: Say goodbye to manual data entry and the associated risk of errors. Expense management software automatically captures and categorizes expenses, ensuring accuracy and consistency in your financial records.

4. Increased Productivity and Efficiency: Free up valuable time and resources by automating tedious tasks like expense tracking and reporting. This allows you and your team to focus on more strategic initiatives that drive business growth.

5. Enhanced Compliance and Audit Readiness: Maintain accurate and organized financial records, simplifying the audit process and minimizing the risk of penalties. The software’s audit trail provides a clear record of all expenses, ensuring transparency and accountability.

6. Improved Cash Flow Management: Optimize your cash flow by gaining insights into your spending patterns and identifying opportunities to reduce unnecessary expenses. This allows you to allocate funds more effectively and improve your overall financial health.

7. Data-Driven Decision Making: Leverage the power of data analytics to gain valuable insights into your business performance. Identify trends, uncover cost-saving opportunities, and make informed decisions to optimize your financial strategy.

Navigating the Landscape: Understanding the Disadvantages of Expense Management Software

While expense management software offers numerous benefits, it’s important to be aware of potential drawbacks to make an informed decision.

1. Initial Implementation Costs: Implementing expense management software may involve initial costs, including software licenses, training, and integration with existing systems. However, these costs are often offset by the long-term savings and efficiencies gained through automation.

2. Learning Curve: Some employees may require training to learn how to use the software effectively. This can take time and effort, but most providers offer comprehensive training resources to facilitate a smooth transition.

3. Integration Challenges: Integrating expense management software with existing systems can pose challenges, especially for businesses with complex IT infrastructure. However, many providers offer seamless integration with popular accounting and business applications.

4. Security Concerns: As with any software that handles sensitive financial data, security is a concern. It’s crucial to choose a provider with robust security measures in place to protect your information.

5. Dependence on Technology: Relying on software can create a dependency on technology. If there are technical issues or outages, it can disrupt your expense management processes. However, reputable providers offer reliable support and uptime guarantees to minimize downtime.

Choosing the Right Software: Key Considerations for Small Businesses

With a wide range of expense management software available, selecting the right solution for your small business is crucial. Consider these key factors to make an informed decision:

1. Scalability: Choose software that can grow with your business. Consider the number of employees you expect to have in the future and ensure the software can handle the increased workload.

2. Features and Functionality: Identify the specific features that are most important to your business. This may include expense tracking, reporting, approval workflows, budgeting, integration with other systems, and mobile app accessibility.

3. Ease of Use: Choose software that is user-friendly and intuitive, even for employees who are not tech-savvy. This will ensure that the software is adopted and used effectively throughout your organization.

4. Cost and Pricing: Consider your budget and choose a software solution that offers a reasonable price point for your needs. Explore different pricing models, such as per-user subscriptions or fixed fees, to find the most cost-effective option.

5. Customer Support and Training: Ensure that the provider offers comprehensive customer support and training resources. This will help you navigate the software, troubleshoot any issues, and maximize its benefits.

6. Security and Data Protection: Prioritize security and choose a provider with robust security measures in place to protect your sensitive financial data.

7. Integration with Existing Systems: Consider the software’s compatibility with your existing accounting and business applications. Seamless integration will streamline your financial processes and eliminate the need for manual data entry.

8. Mobile App Accessibility: If your employees frequently travel or work remotely, choose software with a robust mobile app that allows them to capture receipts, submit expense reports, and access real-time data from their smartphones or tablets.

9. Reviews and Testimonials: Research the software provider and read reviews from other users to gauge their satisfaction and experience. This can provide valuable insights into the software’s performance, ease of use, and customer support.

10. Free Trial or Demo: Take advantage of free trials or demos to test the software and ensure it meets your specific needs. This will allow you to evaluate the software’s features, functionality, and user interface before making a commitment.

FAQs: Addressing Your Common Questions about Expense Management Software

1. Is expense management software suitable for small businesses?

Absolutely! Expense management software is particularly beneficial for small businesses, as it helps streamline financial processes, improve accuracy, and provide valuable insights into spending patterns. The automation and efficiency it offers can be a game-changer for small business owners who often wear many hats and have limited resources.

2. How much does expense management software cost?

The cost of expense management software varies depending on the features, functionality, and pricing model. Some providers offer per-user subscriptions, while others charge fixed fees. There are also free or freemium options available, but these may have limited features. It’s essential to compare pricing plans and choose a solution that fits your budget and needs.

3. What are the benefits of using expense management software?

Expense management software offers numerous benefits, including enhanced financial control, streamlined expense reporting, improved accuracy, increased productivity, enhanced compliance, improved cash flow management, and data-driven decision making. These benefits can significantly improve your business’s financial health and streamline your operations.

4. How can expense management software help me save money?

Expense management software can help you save money by providing insights into your spending patterns, identifying areas where you can cut costs, and optimizing your cash flow. By tracking expenses, analyzing trends, and making informed decisions, you can reduce unnecessary spending and allocate funds more effectively.

5. Is expense management software difficult to use?

Most modern expense management software is designed to be user-friendly and intuitive. Many providers offer comprehensive training resources and customer support to help you navigate the platform and maximize its benefits. Choose software that is easy to learn and use, even for employees who are not tech-savvy.

6. What are the security risks associated with expense management software?

As with any software that handles sensitive financial data, security is a concern. It’s crucial to choose a provider with robust security measures in place, such as encryption, data backups, and access controls. Ensure that the provider complies with relevant data privacy regulations and has a proven track record of security.

7. How can I integrate expense management software with my existing accounting system?

Many expense management software providers offer seamless integration with popular accounting systems, such as QuickBooks, Xero, and Sage. This integration eliminates the need for manual data entry, ensuring consistency and accuracy across your financial records. Choose software that is compatible with your existing systems to streamline your financial processes.

8. What are the best expense management software options for small businesses?

There are many excellent expense management software options available for small businesses. Some popular choices include Expensify, Zoho Expense, Divvy, Divvy, and QuickBooks Self-Employed. It’s essential to research different options and choose a solution that best meets your specific needs and budget.

9. How can I ensure my employees use expense management software effectively?

Provide comprehensive training and support to ensure your employees understand how to use the software effectively. Encourage them to submit expense reports promptly and accurately, and provide clear guidelines on expense policies and procedures. Regular communication and feedback can help foster adoption and ensure that the software is used to its full potential.

10. How can expense management software help me improve my cash flow?

Expense management software can help you improve your cash flow by providing insights into your spending patterns, identifying areas where you can cut costs, and optimizing your cash flow. By tracking expenses, analyzing trends, and making informed decisions, you can reduce unnecessary spending and allocate funds more effectively.

11. Can expense management software help me with tax compliance?

Yes, expense management software can help you with tax compliance by providing accurate and organized financial records. The software’s audit trail provides a clear record of all expenses, simplifying the audit process and minimizing the risk of penalties.

12. What are the best practices for using expense management software?

- Establish clear expense policies and procedures: Define what expenses are eligible for reimbursement, set limits, and provide guidelines for submitting expense reports.

- Train employees on how to use the software: Ensure that all employees understand how to capture receipts, submit expense reports, and access the software’s features.

- Review and approve expense reports promptly: Ensure that expense reports are reviewed and approved in a timely manner to avoid delays and maintain accurate financial records.

- Monitor expenses regularly: Track your expenses and analyze trends to identify areas where you can cut costs and optimize your spending.

- Integrate with your accounting system: Seamless integration will streamline your financial processes and eliminate the need for manual data entry.

13. What are the future trends in expense management software?

Expense management software is constantly evolving, with new features and functionalities being developed to enhance its capabilities. Some future trends include:

- Artificial intelligence (AI) and machine learning (ML): AI and ML will be used to automate more tasks, such as expense categorization, fraud detection, and expense forecasting.

- Increased mobile app functionality: Mobile apps will become even more sophisticated, offering features such as receipt scanning, expense tracking, and real-time reporting.

- Enhanced integration with other business applications: Expense management software will seamlessly integrate with a wider range of business applications, including CRM, project management, and payroll systems.

- Focus on user experience: Software providers will prioritize user experience, making the software more intuitive and user-friendly.

- Increased focus on security and data privacy: Security and data privacy will remain top priorities, with providers implementing robust security measures to protect sensitive financial information.

Empowering Your Business: Taking Action with Expense Management Software

The time is now to unlock the potential of efficient expense management for your small business. By embracing the power of expense management software, you can streamline your financial processes, gain greater control over your spending, and make informed decisions that drive growth and profitability.

Here’s your call to action:

- Research and compare different expense management software options: Explore the features, functionality, pricing, and customer support of various providers to find the solution that best meets your needs.

- Start a free trial or demo: Take advantage of free trials or demos to test the software and ensure it meets your specific requirements.

- Implement the software and train your employees: Once you’ve chosen a solution, implement it and train your employees on how to use it effectively.

- Monitor your expenses and track your progress: Regularly review your expenses and track your progress to identify areas for improvement and maximize the benefits of the software.

By taking these steps, you can empower your small business with the tools and insights needed to succeed in today’s competitive landscape.

Disclaimer: This article is intended to provide general information and should not be considered financial advice. It’s essential to consult with a qualified financial professional to make informed decisions about your business’s financial management.

.

.