Navigating the Labyrinth: Demystifying Enterprise Accounting Software for Your Business

.

.

Welcome, fellow business leaders! In today’s dynamic and ever-evolving business landscape, the need for robust and reliable financial management systems has never been more critical. As your company grows, so too do the complexities of your financial operations. Managing transactions, tracking expenses, generating reports, and ensuring regulatory compliance can become a daunting task without the right tools. This is where enterprise accounting software steps in, offering a comprehensive solution to streamline your financial processes and empower you with actionable insights.

Imagine a world where your financial data is readily accessible, analyzed in real-time, and transformed into actionable insights that fuel strategic decision-making. This is the power of enterprise accounting software. It’s not just about recording transactions; it’s about harnessing the power of your financial data to drive growth, optimize operations, and gain a competitive edge.

But navigating the vast landscape of enterprise accounting software can feel like venturing into a labyrinth. With countless options available, choosing the right solution for your specific needs can be a daunting task. This article aims to guide you through this complex world, providing a comprehensive overview of enterprise accounting software, its benefits, drawbacks, and key considerations for your business.

From spreadsheets to sophisticated solutions: Remember the days of juggling spreadsheets and manual calculations? While these methods may have sufficed for smaller businesses, they become cumbersome and error-prone as your organization scales. Enterprise accounting software offers a more efficient and accurate alternative, automating key processes and providing a centralized platform for managing your finances.

.

.

Beyond basic bookkeeping: Enterprise accounting software goes beyond basic bookkeeping functionalities. It empowers you with advanced features like budgeting, forecasting, financial reporting, and even inventory management. This comprehensive approach allows you to gain a holistic view of your financial health, identify areas for improvement, and make data-driven decisions.

Scalability for growth: As your business expands, your accounting needs will inevitably evolve. Enterprise accounting software is designed to scale with your growth, offering flexible solutions that can adapt to your changing requirements. Whether you’re adding new departments, expanding into new markets, or integrating with other business systems, the right software will seamlessly accommodate your evolving needs.

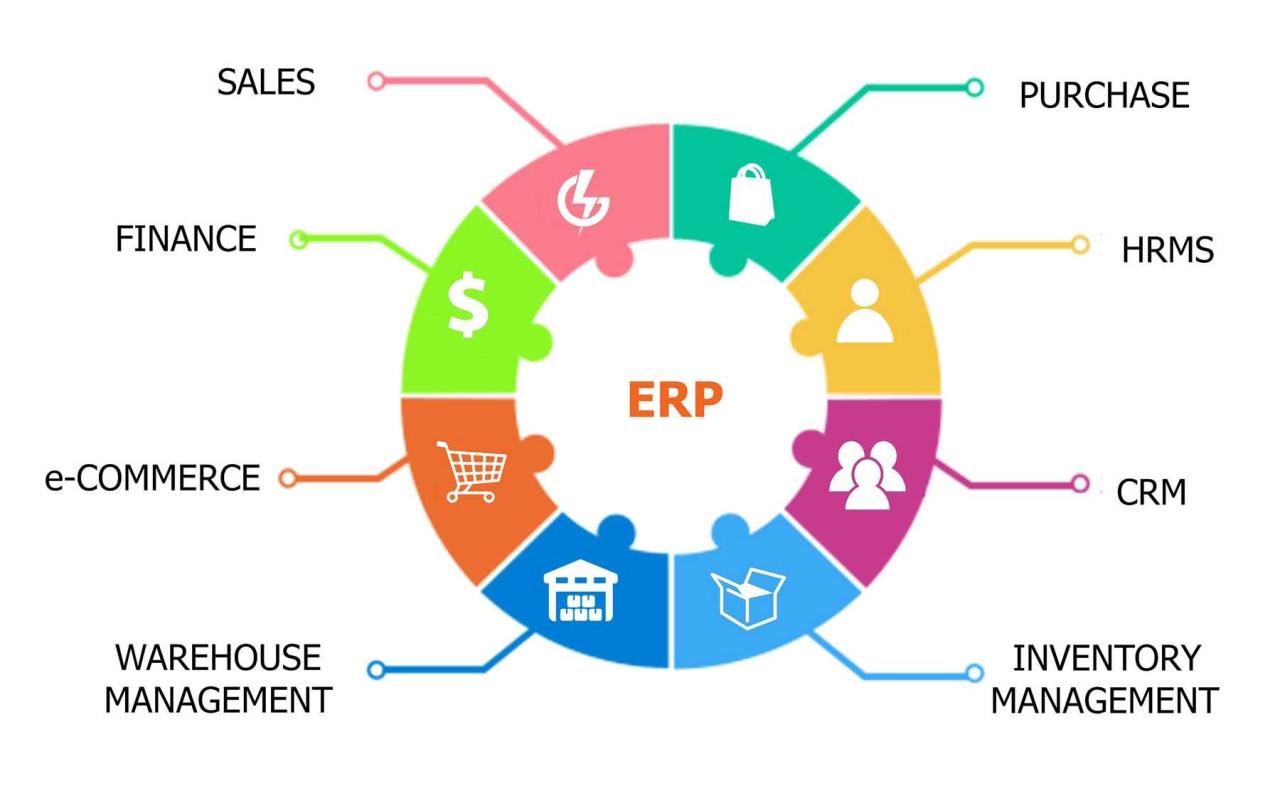

The power of integration: In today’s interconnected business world, integration is key. Enterprise accounting software seamlessly integrates with other critical business applications like CRM, ERP, and e-commerce platforms, creating a unified ecosystem for managing your operations. This integration ensures data consistency, reduces manual data entry, and streamlines workflows across your organization.

Unlocking the potential of your financial data: Enterprise accounting software doesn’t just store your data; it transforms it into valuable insights. With advanced analytics and reporting capabilities, you can gain a deeper understanding of your financial performance, identify trends, and make informed decisions to drive profitability.

Embracing the future of finance: Enterprise accounting software is more than just a tool; it’s a strategic asset that empowers you to navigate the complexities of modern business. By embracing the power of automation, data analytics, and integration, you can unlock the full potential of your financial data and drive your business towards success.

Unveiling the Advantages of Enterprise Accounting Software

.

.

1. Automation: Streamlining Your Processes

Imagine a world where repetitive tasks like data entry, invoice processing, and reconciliation are automated, freeing up your valuable time for strategic initiatives. Enterprise accounting software empowers you to automate these mundane tasks, significantly reducing manual effort and minimizing the risk of human error.

The Power of Automation:

- Invoice Processing: Automating invoice processing streamlines the entire cycle, from receiving invoices to generating payments. This reduces manual data entry, minimizes errors, and ensures timely payments.

- Data Entry: By automating data entry, you eliminate the need for manual input, reducing the risk of errors and freeing up valuable time for your accounting team.

- Reconciliation: Reconciliation tasks, often time-consuming and prone to errors, can be automated, ensuring accurate financial records and reducing the risk of discrepancies.

- Bank Feeds: Enterprise accounting software seamlessly integrates with your bank accounts, automatically importing transactions and eliminating the need for manual data entry.

.

.

The Benefits of Automation:

.

.

- Increased Efficiency: Automation streamlines processes, saving time and resources for your accounting team.

- Reduced Errors: Automating tasks eliminates the risk of human error, ensuring accurate financial records.

- Improved Accuracy: Automated data entry and reconciliation ensure greater accuracy and reliability in your financial data.

- Enhanced Productivity: By freeing up your team from repetitive tasks, automation allows them to focus on higher-value activities like analysis and strategic planning.

.

.

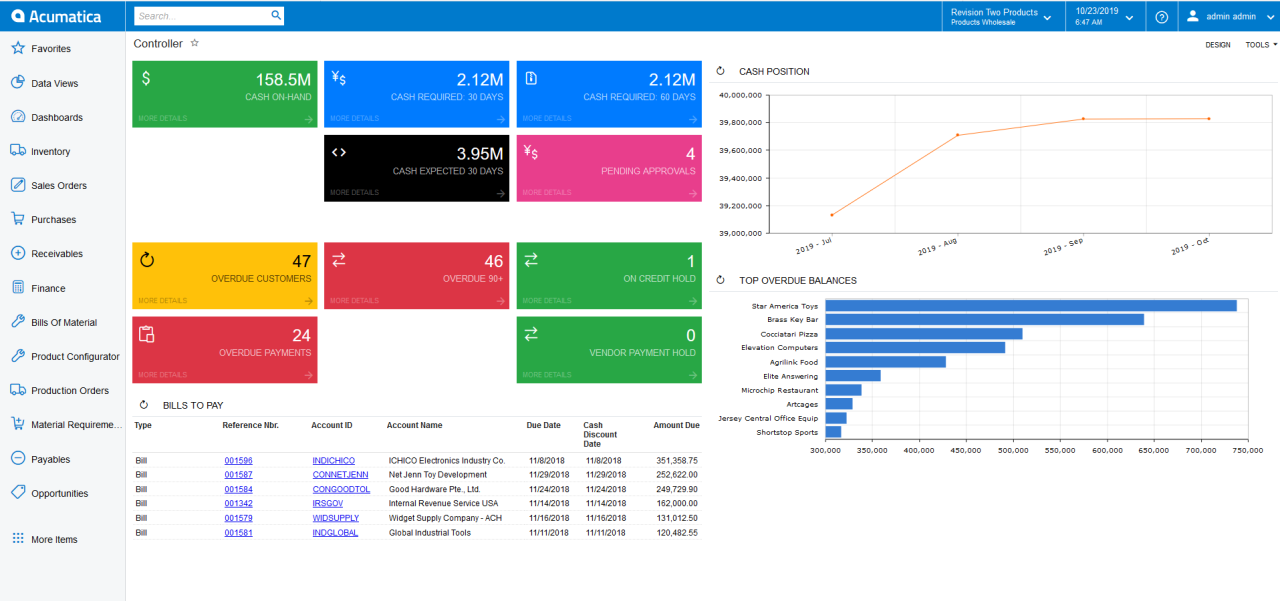

2. Real-Time Insights: Making Data-Driven Decisions

Enterprise accounting software provides real-time access to your financial data, allowing you to make informed decisions based on up-to-the-minute information. This eliminates the need for manual reporting and provides a dynamic view of your financial performance.

The Power of Real-Time Insights:

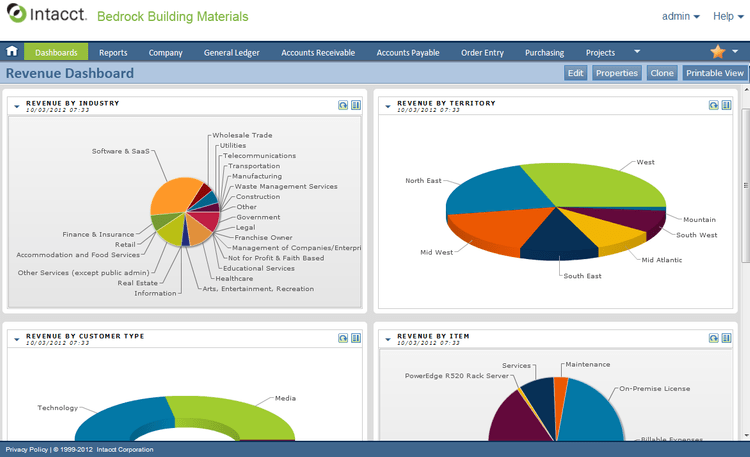

- Financial Performance Tracking: Monitor your revenue, expenses, and profitability in real-time, gaining a clear picture of your business’s financial health.

- Cash Flow Management: Track your cash flow in real-time, identifying potential cash shortages and optimizing your financial planning.

- Inventory Management: Gain real-time visibility into your inventory levels, optimizing stock management and reducing storage costs.

- Performance Dashboards: Customized dashboards provide a comprehensive overview of key financial metrics, allowing you to quickly identify trends and areas for improvement.

The Benefits of Real-Time Insights:

- Proactive Decision-Making: Real-time data empowers you to make informed decisions based on current financial performance.

- Improved Forecasting: Accurate and timely data enables more reliable forecasting, supporting strategic planning and resource allocation.

- Enhanced Risk Management: Real-time insights help you identify potential risks early on, allowing you to take proactive measures to mitigate them.

- Increased Accountability: Real-time data provides transparency and accountability, ensuring everyone in your organization is aligned on financial performance.

3. Comprehensive Reporting: Gaining Actionable Insights

Enterprise accounting software offers a wide range of reporting capabilities, allowing you to generate customized reports that provide valuable insights into your financial performance. This enables you to analyze trends, identify areas for improvement, and make data-driven decisions.

The Power of Comprehensive Reporting:

- Financial Statements: Generate accurate and comprehensive financial statements, including balance sheets, income statements, and cash flow statements.

- Custom Reports: Create customized reports based on your specific needs, allowing you to analyze data in a way that is most relevant to your business.

- Trend Analysis: Identify trends in your financial performance, providing valuable insights into your business’s growth trajectory and potential areas for improvement.

- Comparative Analysis: Compare your financial performance to industry benchmarks or previous periods, gaining a deeper understanding of your strengths and weaknesses.

The Benefits of Comprehensive Reporting:

- Data-Driven Decision-Making: Reports provide actionable insights that inform strategic decision-making and drive profitability.

- Improved Financial Planning: Data-driven insights support more accurate financial planning, allowing you to allocate resources effectively.

- Enhanced Compliance: Comprehensive reporting ensures compliance with regulatory requirements, reducing the risk of penalties and fines.

- Increased Transparency: Reports provide transparency into your financial performance, fostering trust and accountability within your organization.

4. Scalability: Adapting to Your Growth

Enterprise accounting software is designed to scale with your business, offering flexible solutions that can adapt to your changing needs. As your company grows, you can easily add users, expand functionalities, and integrate with other business systems without disrupting your financial operations.

The Power of Scalability:

- User Management: Easily add new users and assign specific roles and permissions, ensuring secure access to financial data.

- Feature Expansion: As your business grows, you can expand the software’s functionalities to accommodate your evolving needs.

- Integration with Other Systems: Seamlessly integrate with other business applications like CRM, ERP, and e-commerce platforms, creating a unified ecosystem for managing your operations.

- Cloud-Based Solutions: Cloud-based enterprise accounting software offers scalability and flexibility, allowing you to access your data from anywhere and scale your resources as needed.

The Benefits of Scalability:

- Flexibility: Enterprise accounting software adapts to your changing needs, ensuring a seamless transition as your business grows.

- Cost-Effectiveness: Scalable solutions allow you to pay for the features you need, avoiding unnecessary expenses.

- Improved Collaboration: Scalability enables seamless collaboration across departments, ensuring everyone has access to the information they need.

- Future-Proofing: Enterprise accounting software provides a future-proof solution, ensuring your financial management system can adapt to your evolving business needs.

5. Security: Protecting Your Valuable Data

Financial data is highly sensitive, and protecting it from unauthorized access is paramount. Enterprise accounting software employs robust security measures to safeguard your data, ensuring its integrity and confidentiality.

The Power of Security:

- Data Encryption: Enterprise accounting software encrypts your financial data, making it unreadable to unauthorized individuals.

- Access Control: Implement granular access control measures, allowing you to assign specific permissions to different users based on their roles and responsibilities.

- Two-Factor Authentication: Enhance security with two-factor authentication, requiring users to provide two forms of verification before accessing sensitive data.

- Regular Security Updates: Enterprise accounting software providers constantly update their systems to address emerging security threats, ensuring your data remains protected.

The Benefits of Security:

- Data Integrity: Robust security measures ensure the integrity and accuracy of your financial data, protecting it from tampering or corruption.

- Confidentiality: Enterprise accounting software protects your sensitive financial information from unauthorized access, ensuring confidentiality.

- Compliance: Security measures help you comply with industry regulations and data privacy laws, reducing the risk of penalties and fines.

- Peace of Mind: Knowing your financial data is secure provides peace of mind and allows you to focus on growing your business.

Navigating the Challenges: A Look at the Disadvantages of Enterprise Accounting Software

1. Implementation Complexity: Implementing enterprise accounting software can be a complex process, requiring careful planning and execution. This can involve significant time, effort, and resources, especially for larger organizations with complex financial structures.

The Challenges of Implementation:

- Data Migration: Migrating your existing financial data into the new software system can be a time-consuming and error-prone process.

- Customization: Configuring the software to meet your specific business needs and workflows can be challenging and require specialized expertise.

- Training: Training your employees on the new software system can be time-consuming and require ongoing support.

- Integration with Existing Systems: Integrating the software with your existing business systems can be complex and require careful planning.

Mitigating the Challenges:

- Thorough Planning: Carefully plan the implementation process, defining clear goals, timelines, and resources.

- Experienced Implementation Partners: Engage experienced implementation partners who can guide you through the process and ensure a smooth transition.

- Phased Implementation: Implement the software in phases, starting with key modules and gradually expanding as your team gains familiarity.

- Ongoing Support: Ensure you have access to ongoing support from the software provider to address any technical issues or questions.

2. Cost: Enterprise accounting software can be a significant investment, especially for larger organizations with complex needs. The cost can include software licenses, implementation services, ongoing support, and potentially hardware upgrades.

The Cost Considerations:

- Software Licenses: The cost of software licenses can vary depending on the features, number of users, and subscription model.

- Implementation Services: Implementing enterprise accounting software often requires professional services, which can add to the overall cost.

- Ongoing Support: Maintaining the software and accessing ongoing support from the provider can incur recurring costs.

- Hardware Upgrades: Depending on the software’s requirements, you may need to upgrade your hardware infrastructure, adding to the overall expense.

Balancing Cost and Value:

- Return on Investment: Carefully assess the potential return on investment (ROI) of enterprise accounting software, considering the cost savings, efficiency gains, and improved decision-making.

- Cost-Benefit Analysis: Conduct a thorough cost-benefit analysis to compare the cost of the software with the potential benefits.

- Explore Different Subscription Models: Consider different subscription models offered by software providers, choosing the option that best fits your budget and needs.

- Negotiate with Vendors: Don’t be afraid to negotiate with software vendors to secure the best possible pricing and terms.

3. Learning Curve: Enterprise accounting software can have a steep learning curve, requiring employees to adapt to new functionalities, workflows, and reporting mechanisms. This can lead to initial resistance and require significant training and support.

The Learning Curve Challenges:

- New Interface: Employees need to familiarize themselves with the software’s interface, which can be different from their previous accounting systems.

- New Processes: Enterprise accounting software often introduces new workflows and processes, requiring employees to adapt their habits.

- Advanced Features: Learning to utilize the software’s advanced features, such as reporting and analytics, can take time and effort.

- Ongoing Support: Employees may require ongoing support and training to fully utilize the software’s capabilities.

Overcoming the Learning Curve:

- Phased Training: Implement a phased training program, starting with basic functionalities and gradually introducing more advanced features.

- User-Friendly Interface: Choose software with a user-friendly interface that is intuitive and easy to navigate.

- Online Resources and Support: Leverage online resources, tutorials, and documentation provided by the software vendor.

- Dedicated Support Team: Ensure you have access to a dedicated support team to answer questions and provide assistance as needed.

4. Data Security Concerns: While enterprise accounting software employs robust security measures, data security remains a concern for businesses. Hackers are constantly targeting sensitive financial data, and it’s crucial to implement additional security measures to protect your information.

Data Security Considerations:

- Data Encryption: Ensure the software encrypts your data both at rest and in transit, making it unreadable to unauthorized individuals.

- Access Control: Implement granular access control measures, allowing you to assign specific permissions to different users based on their roles and responsibilities.

- Two-Factor Authentication: Enhance security with two-factor authentication, requiring users to provide two forms of verification before accessing sensitive data.

- Regular Security Updates: Ensure the software provider regularly updates the system to address emerging security threats.

Protecting Your Data:

- Security Audits: Conduct regular security audits to identify potential vulnerabilities and implement necessary safeguards.

- Employee Training: Train employees on best practices for data security, including password management and phishing awareness.

- Data Backup and Recovery: Implement a robust data backup and recovery plan to protect your financial data from loss or corruption.

- Compliance with Security Standards: Ensure your software provider adheres to industry security standards and regulations.

5. Limited Customization: While enterprise accounting software offers a wide range of features, it may not always fully meet the specific needs of every business. This can lead to workarounds or the need for custom development, which can be costly and time-consuming.

Customization Challenges:

- Standard Features: Enterprise accounting software typically offers a set of standard features, which may not fully align with your unique business processes.

- Custom Development: Customizing the software to meet your specific needs can require additional development work, which can be expensive and time-consuming.

- Integration Challenges: Integrating custom solutions with the existing software can be complex and require specialized expertise.

Finding the Right Balance:

- Assess Your Needs: Carefully assess your specific business needs and determine how well the software aligns with your requirements.

- Explore Customization Options: Investigate the software provider’s customization options and determine if they meet your needs.

- Consider Alternatives: If the software’s customization capabilities are limited, consider alternative solutions that offer greater flexibility.

- Evaluate the Cost and Benefits: Weigh the cost and benefits of customization, ensuring it aligns with your overall business objectives.

Demystifying Enterprise Accounting Software: A Comprehensive Overview

Enterprise accounting software is a powerful tool that can streamline financial processes, provide real-time insights, and empower businesses to make data-driven decisions. However, choosing the right software solution requires careful consideration of your specific needs, budget, and organizational structure.

Key Considerations for Choosing Enterprise Accounting Software:

- Business Size and Complexity: Consider the size and complexity of your business, as well as your current accounting processes.

- Industry-Specific Requirements: Look for software that caters to the specific needs of your industry, such as manufacturing, retail, or healthcare.

- Scalability and Growth: Choose software that can scale with your business, adapting to your evolving needs as you grow.

- Integration with Other Systems: Ensure the software seamlessly integrates with other critical business applications like CRM, ERP, and e-commerce platforms.

- User Interface and Ease of Use: Select software with a user-friendly interface that is intuitive and easy for your team to learn and use.

- Reporting and Analytics: Look for software that offers comprehensive reporting and analytics capabilities, allowing you to gain valuable insights into your financial performance.

- Security and Compliance: Ensure the software employs robust security measures to protect your sensitive financial data and comply with industry regulations.

- Cost and Subscription Models: Carefully evaluate the cost of the software, including licenses, implementation services, and ongoing support. Consider different subscription models to find the option that best fits your budget and needs.

- Customer Support and Training: Choose a software provider that offers excellent customer support and training resources to help you implement and utilize the software effectively.

Choosing the Right Solution:

- Research and Compare: Research different software options and compare their features, pricing, and customer reviews.

- Demo and Trial: Request demos and trial periods to experience the software firsthand and assess its usability.

- Seek Expert Advice: Consult with accounting professionals or technology consultants to get expert advice on choosing the right software for your business.

Enterprise Accounting Software: A Transformative Tool for Your Business

By embracing the power of enterprise accounting software, businesses can streamline their financial processes, gain valuable insights, and make data-driven decisions that drive growth and profitability. However, it’s crucial to carefully consider your specific needs, budget, and organizational structure to choose the right solution for your business. With careful planning, implementation, and ongoing support, enterprise accounting software can become a transformative tool that empowers you to navigate the complexities of modern business and achieve your financial goals.

Frequently Asked Questions (FAQs)

1. What are the main types of enterprise accounting software?

Enterprise accounting software can be broadly categorized into two main types: on-premises and cloud-based. On-premises software is installed and managed on your company’s servers, while cloud-based software is accessed via the internet. Both options have their advantages and disadvantages, and the best choice for your business will depend on your specific needs and preferences.

2. What are the key features of enterprise accounting software?

Enterprise accounting software typically includes a wide range of features, such as:

- General Ledger: Tracks all financial transactions and balances.

- Accounts Payable: Manages invoices and payments to suppliers.

- Accounts Receivable: Tracks customer invoices and payments.

- Fixed Assets: Manages the depreciation of fixed assets.

- Inventory Management: Tracks inventory levels, orders, and sales.

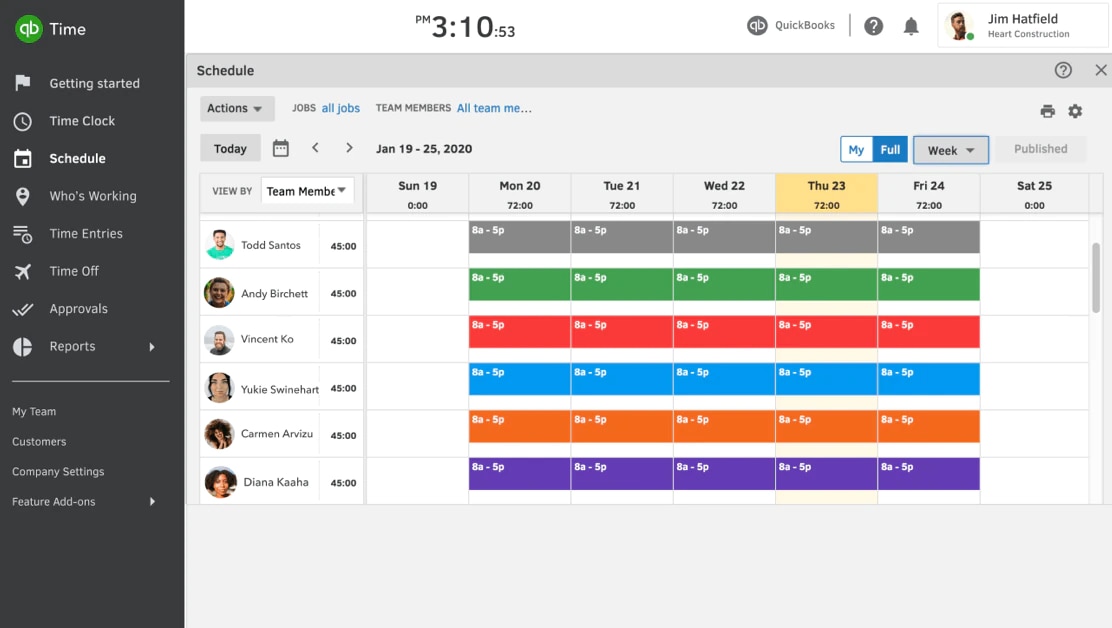

- Payroll: Processes payroll and manages employee compensation.

- Reporting and Analytics: Generates financial reports and provides data analytics.

- Integration with Other Systems: Integrates with other business applications like CRM, ERP, and e-commerce platforms.

3. How do I choose the right enterprise accounting software for my business?

Choosing the right enterprise accounting software requires careful consideration of your specific needs, budget, and organizational structure. Here are some key factors to consider:

- Business Size and Complexity: The size and complexity of your business will influence your software requirements.

- Industry-Specific Needs: Look for software that caters to the specific needs of your industry.

- Scalability and Growth: Choose software that can scale with your business as you grow.

- Integration with Other Systems: Ensure the software seamlessly integrates with other critical business applications.

- User Interface and Ease of Use: Select software with a user-friendly interface that is intuitive and easy for your team to learn and use.

- Reporting and Analytics: Look for software that offers comprehensive reporting and analytics capabilities.

- Security and Compliance: Ensure the software employs robust security measures to protect your sensitive financial data.

- Cost and Subscription Models: Carefully evaluate the cost of the software, including licenses, implementation services, and ongoing support. Consider different subscription models to find the option that best fits your budget and needs.

- Customer Support and Training: Choose a software provider that offers excellent customer support and training resources.

4. How much does enterprise accounting software cost?

The cost of enterprise accounting software can vary significantly depending on the features, number of users, and subscription model. Some software providers offer monthly or annual subscription fees, while others charge a one-time purchase price. It’s important to compare different software options and their pricing models to find the best value for your business.

5. What are the benefits of using cloud-based enterprise accounting software?

Cloud-based enterprise accounting software offers several benefits, including:

- Scalability and Flexibility: Cloud-based software can be easily scaled to accommodate your growing business needs.

- Accessibility: Access your financial data from anywhere with an internet connection.

- Cost-Effectiveness: Pay only for the features you need and avoid upfront hardware investments.

- Automatic Updates: Software updates are automatically applied, ensuring you always have the latest features and security patches.

6. What are the drawbacks of using on-premises enterprise accounting software?

On-premises enterprise accounting software has some drawbacks, including:

- Higher Initial Investment: On-premises software requires a significant upfront investment in hardware, software licenses, and installation services.

- Maintenance and Support: Maintaining and supporting on-premises software can be costly and time-consuming.

- Limited Scalability: Scaling on-premises software can be challenging and require significant hardware upgrades.

7. What are some popular enterprise accounting software options?

Some popular enterprise accounting software options include:

- SAP: A comprehensive ERP system with robust accounting functionalities.

- Oracle: Another leading ERP provider with advanced accounting capabilities.

- Sage: A popular accounting software solution for businesses of all sizes.

- NetSuite: A cloud-based ERP system with comprehensive accounting features.

- Xero: A cloud-based accounting software solution designed for small and medium-sized businesses.

- QuickBooks Online: A cloud-based accounting software solution for small businesses.

8. How do I implement enterprise accounting software in my business?

Implementing enterprise accounting software requires careful planning and execution. Here are some steps to follow:

- Define Your Requirements: Clearly define your business needs and the functionalities you require from the software.

- Choose a Software Provider: Research and compare different software options and choose the one that best meets your requirements.

- Plan the Implementation: Develop a detailed implementation plan, including timelines, resources, and training.

- Data Migration: Migrate your existing financial data into the new software system.

- User Training: Train your employees on the new software system and its functionalities.

- Go Live and Ongoing Support: Launch the new software system and provide ongoing support to your users.

9. What are the best practices for using enterprise accounting software?

Here are some best practices for using enterprise accounting software effectively:

- Regular Data Entry: Ensure all financial transactions are entered into the software promptly and accurately.

- Reconciliation: Regularly reconcile your bank statements and other financial accounts with the software’s records.

- Reporting and Analysis: Utilize the software’s reporting and analytics capabilities to gain valuable insights into your financial performance.

- Security Measures: Implement robust security measures to protect your sensitive financial data.

- Regular Updates: Keep your software up to date with the latest features and security patches.

10. How can I improve my financial reporting using enterprise accounting software?

Enterprise accounting software offers a wide range of reporting capabilities that can enhance your financial reporting. Here are some tips:

- Customize Reports: Use the software’s reporting tools to create customized reports that meet your specific needs.

- Analyze Trends: Utilize the software’s analytics capabilities to identify trends in your financial performance.

- Compare Performance: Compare your financial performance to industry benchmarks or previous periods to identify areas for improvement.

- Automate Reports: Automate the generation of regular reports to save time and ensure consistency.

11. What are the key benefits of using enterprise accounting software for financial planning and forecasting?

Enterprise accounting software can significantly enhance your financial planning and forecasting capabilities. Here are some key benefits:

- Real-Time Data: Access real-time financial data to create more accurate forecasts.

- Advanced Analytics: Utilize the software’s analytics capabilities to identify trends and patterns in your financial performance.

- Scenario Planning: Create different scenarios to test the impact of various factors on your financial performance.

- Automated Budgeting: Automate the budgeting process to save time and improve accuracy.

12. How can enterprise accounting software help me improve my cash flow management?

Enterprise accounting software can provide valuable tools for managing your cash flow effectively. Here are some ways:

- Cash Flow Forecasting: Create accurate cash flow forecasts to anticipate potential shortages or surpluses.

- Account Receivable Management: Track customer invoices and payments to optimize cash collection.

- Account Payable Management: Manage supplier invoices and payments to ensure timely payments and maintain good relationships.

- Bank Reconciliation: Reconcile your bank statements with the software’s records to identify any discrepancies.

13. What are some common challenges businesses face when implementing enterprise accounting software?

Businesses often face challenges when implementing enterprise accounting software, including:

- Data Migration: Migrating existing financial data into the new software system can be complex and time-consuming.

- Customization: Configuring the software to meet specific business needs can require specialized expertise.

- User Training: Training employees on the new software system can be challenging and require ongoing support.

- Integration with Existing Systems: Integrating the software with existing business systems can be complex and require careful planning.

Embracing the Future of Finance: A Call to Action

The era of spreadsheets and manual calculations is fading into the past. Today’s businesses require robust and reliable financial management systems that can keep pace with their growth and evolving needs. Enterprise accounting software offers a comprehensive solution to streamline your financial processes, provide real-time insights, and empower you to make data-driven decisions that drive profitability.

Don’t be afraid to embrace the future of finance. By investing in the right enterprise accounting software, you can unlock the full potential of your financial data, optimize your operations, and gain a competitive edge in today’s dynamic business landscape.

Take the first step towards a brighter financial future. Research different software options, compare their features and pricing, and choose the solution that best aligns with your specific needs and budget. Consult with accounting professionals or technology consultants for expert advice on choosing the right software for your business.

Remember, your financial data is a valuable asset. By investing in the right enterprise accounting software, you can protect your data, gain valuable insights, and make informed decisions that drive your business towards success.

Disclaimer: This article is intended for informational purposes only and should not be construed as financial or legal advice. It’s always best to consult with qualified professionals for personalized guidance on your specific situation.

.

.