Unveiling the Essence of ERM: A Comprehensive Guide to Enterprise Risk Management

Introduction

In the ever-evolving landscape of modern business, organizations are confronted with an intricate tapestry of risks that can threaten their stability, reputation, and financial well-being. To navigate these challenges effectively, enterprises have embraced the concept of Enterprise Risk Management (ERM), a comprehensive approach to identifying, assessing, and mitigating risks across the organization.

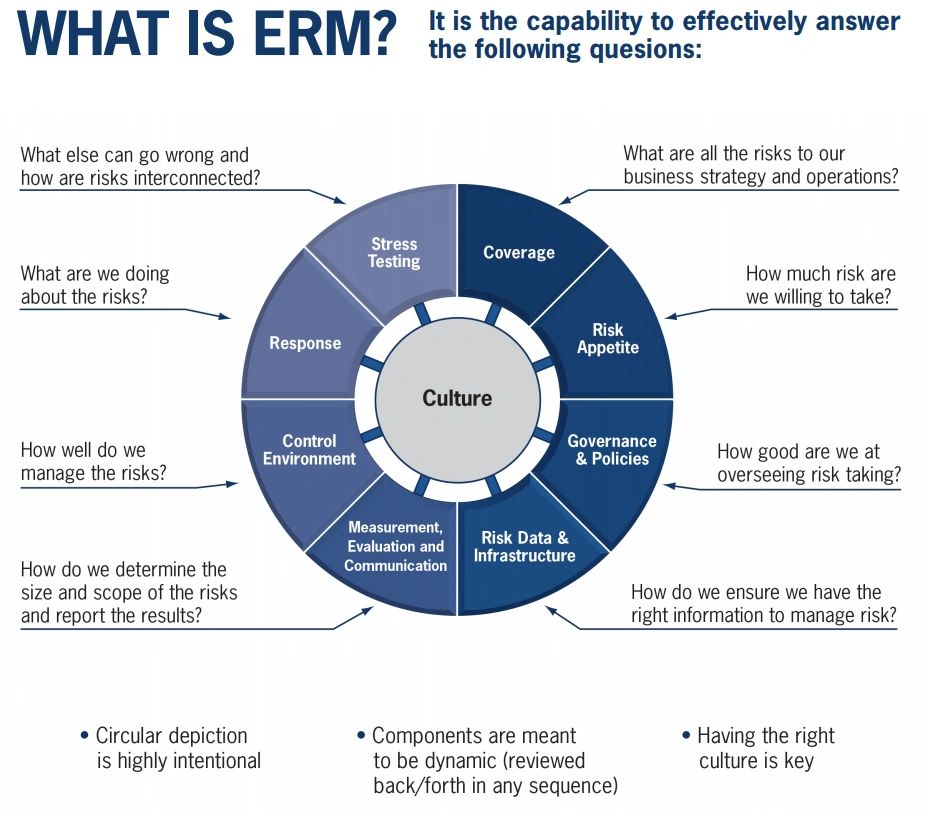

Understanding ERM: A Holistic Approach to Risk Management

ERM encompasses a systematic and proactive framework that enables organizations to gain a comprehensive understanding of their risk landscape. It involves the continuous identification, assessment, and prioritization of risks, followed by the development and implementation of tailored mitigation strategies. By adopting an enterprise-wide perspective, ERM empowers organizations to make informed decisions, enhance resilience, and achieve their strategic objectives.

Key Pillars of ERM: A Foundation for Risk Mitigation

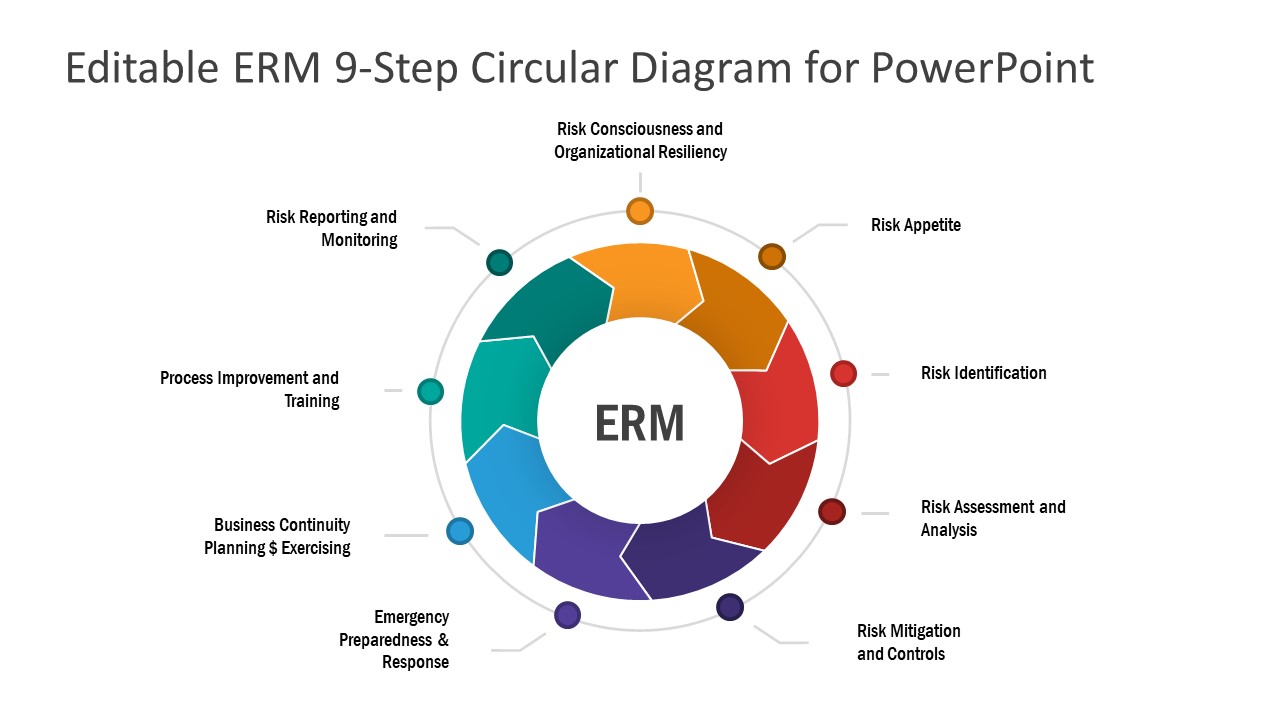

ERM is underpinned by several key pillars that provide a structured approach to risk management:

- Risk Identification: The process of systematically identifying and documenting potential risks that may impact the organization’s objectives.

- Risk Assessment: Evaluating the likelihood and potential impact of identified risks to prioritize them based on their severity.

- Risk Mitigation: Developing and implementing strategies to reduce the likelihood and/or impact of prioritized risks.

- Risk Monitoring: Continuously monitoring risks and their potential impact to ensure timely and effective mitigation.

- Risk Reporting: Communicating risk information to relevant stakeholders to facilitate decision-making and ensure accountability.

Benefits of ERM: Enhancing Organizational Resilience

Organizations that effectively implement ERM reap a multitude of benefits that contribute to their long-term success:

- Improved Risk Visibility: ERM provides a comprehensive view of all risks facing the organization, enabling informed decision-making.

- Enhanced Risk Management: ERM establishes a systematic and proactive approach to risk management, ensuring timely and effective mitigation strategies.

- Increased Resilience: By proactively addressing risks, organizations enhance their resilience and ability to withstand adverse events.

- Improved Compliance: ERM helps organizations comply with regulatory requirements and industry best practices related to risk management.

- Increased Stakeholder Confidence: Effective ERM instills confidence in stakeholders, including investors, customers, and employees, by demonstrating a commitment to risk management.

Disadvantages of ERM: Potential Challenges

While ERM offers significant benefits, it is not without its potential challenges:

- Resource-Intensive: ERM can be resource-intensive, requiring dedicated personnel, technology, and ongoing maintenance.

- Complexity: ERM can be complex to implement and manage, especially in large and complex organizations.

- Cultural Barriers: Resistance to change and a lack of risk awareness can hinder the effective implementation of ERM.

- Data Quality: The quality of risk data is crucial for effective ERM, and ensuring data accuracy and reliability can be challenging.

- Integration Challenges: Integrating ERM with other organizational processes and systems can be complex and time-consuming.

Advantages of ERM: Overcoming the Challenges

Despite the potential challenges, the advantages of ERM far outweigh the drawbacks:

- Improved Risk Management: ERM provides a structured and comprehensive approach to risk management, reducing the likelihood and impact of adverse events.

- Enhanced Decision-Making: ERM empowers organizations with the information and insights they need to make informed decisions and allocate resources effectively.

- Increased Agility: ERM enables organizations to respond quickly and effectively to changing risks and market conditions.

- Improved Stakeholder Confidence: Effective ERM instills confidence in stakeholders, including investors, customers, and employees, by demonstrating a commitment to risk management.

- Compliance with Regulations: ERM helps organizations comply with regulatory requirements and industry best practices related to risk management.

Disadvantages of ERM: Mitigating the Risks

The potential risks associated with ERM can be mitigated through careful planning and implementation:

- Resource Allocation: Organizations should allocate sufficient resources to ERM to ensure its effective implementation and ongoing maintenance.

- Change Management: Effective change management strategies can help overcome resistance to change and foster a culture of risk awareness.

- Data Management: Establishing robust data management practices ensures the accuracy and reliability of risk data.

- Integration Planning: Careful planning and execution are crucial for successful integration of ERM with other organizational processes and systems.

- Continuous Improvement: ERM should be viewed as an ongoing process, with regular reviews and updates to ensure its effectiveness and alignment with the organization’s evolving risk landscape.

Conclusion: Embracing ERM for Organizational Success

In today’s dynamic business environment, ERM is an indispensable tool for organizations seeking to navigate risks, enhance resilience, and achieve their strategic objectives. By embracing the principles of ERM, organizations can gain a comprehensive understanding of their risk landscape, develop tailored mitigation strategies, and make informed decisions to safeguard their future. While ERM may present challenges, the benefits it offers far outweigh the risks, making it a crucial investment for organizations committed to long-term success.